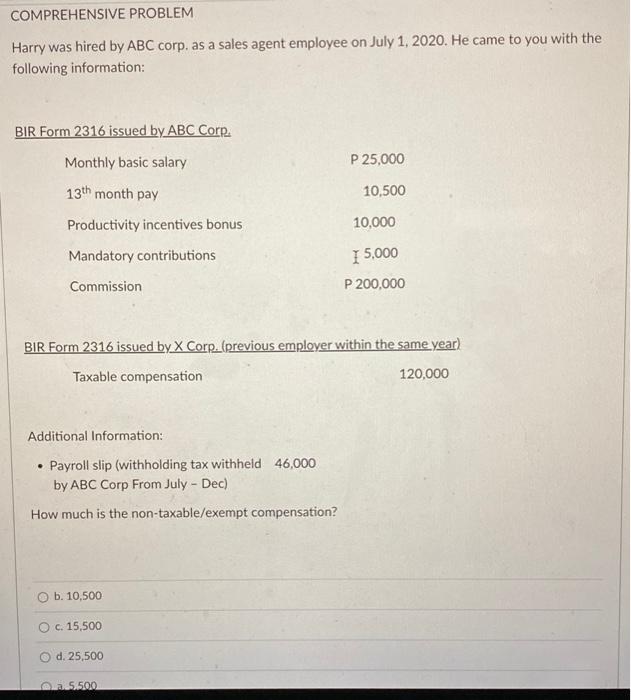

Question: 40 COMPREHENSIVE PROBLEM Harry was hired by ABC corp. as a sales agent employee on July 1, 2020. He came to you with the following

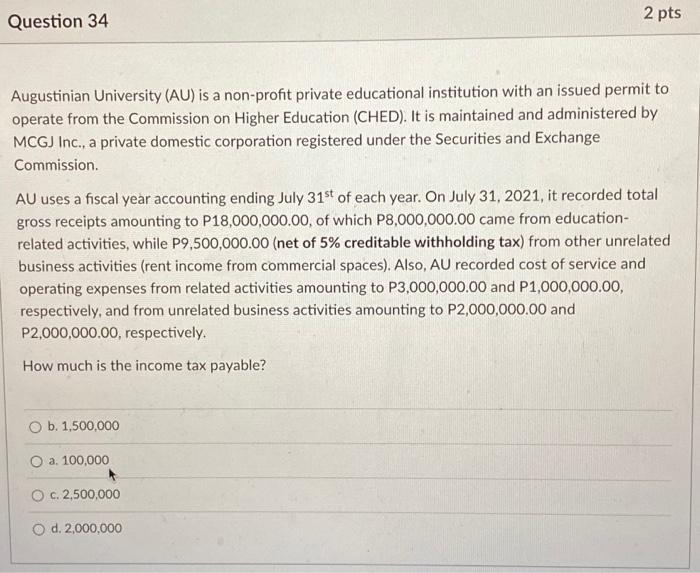

COMPREHENSIVE PROBLEM Harry was hired by ABC corp. as a sales agent employee on July 1, 2020. He came to you with the following information: BIR Form 2316 issued by ABC Corp. Monthly basic salary P 25,000 13th month pay 10,500 Productivity incentives bonus 10,000 Mandatory contributions I 5,000 Commission P 200,000 BIR Form 2316 issued by X Corp. (previous emplover within the same year) Taxable compensation 120,000 Additional Information: Payroll slip (withholding tax withheld 46,000 by ABC Corp From July - Dec) How much is the non-taxable/exempt compensation? b. 10,500 O c. 15,500 O d. 25,500 5500 2 pts Question 34 Augustinian University (AU) is a non-profit private educational institution with an issued permit to operate from the Commission on Higher Education (CHED). It is maintained and administered by MCGJ Inc., a private domestic corporation registered under the Securities and Exchange Commission AU uses a fiscal year accounting ending July 31st of each year. On July 31, 2021, it recorded total gross receipts amounting to P18,000,000.00, of which P8,000,000.00 came from education- related activities, while P9,500,000.00 (net of 5% creditable withholding tax) from other unrelated business activities (rent income from commercial spaces). Also, AU recorded cost of service and operating expenses from related activities amounting to P3,000,000.00 and P1,000,000.00 respectively, and from unrelated business activities amounting to P2,000,000.00 and P2,000,000.00, respectively. How much is the income tax payable? O b. 1,500,000 a. 100,000 O c. 2,500,000 O d. 2,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts