Question: NO NEED TO EXPLAIN PLS ANSWER Question 55 2 pts COMPREHENSIVE PROBLEM Harry was hired by ABC corp. as a sales agent employee on July

NO NEED TO EXPLAIN PLS ANSWER

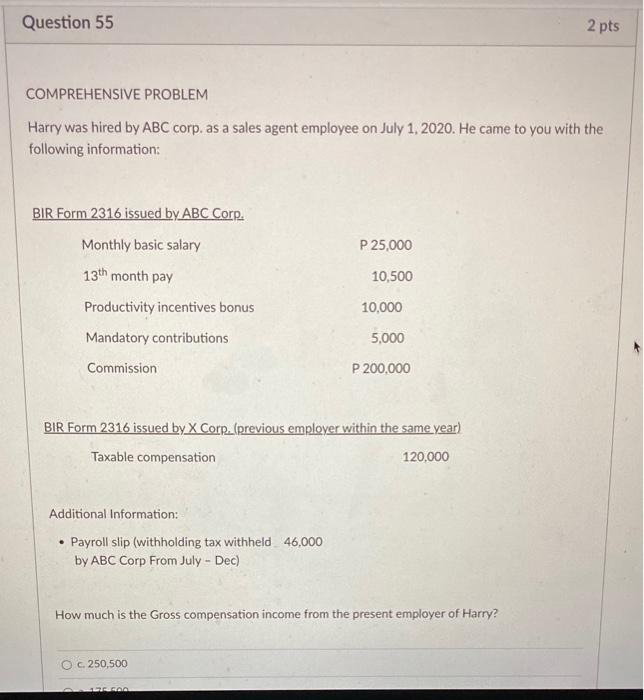

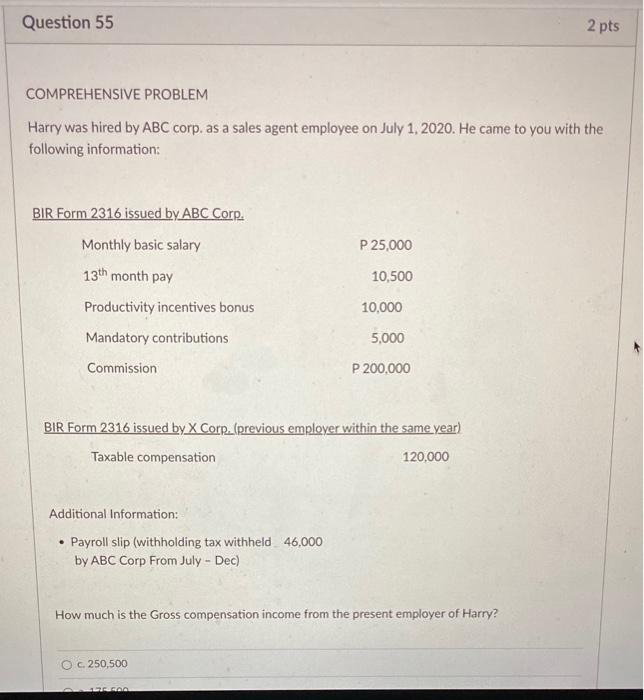

Question 55 2 pts COMPREHENSIVE PROBLEM Harry was hired by ABC corp. as a sales agent employee on July 1, 2020. He came to you with the following information: P 25,000 10,500 BIR Form 2316 issued by ABC Corr. Monthly basic salary 13th month pay Productivity incentives bonus Mandatory contributions Commission 10,000 5,000 P200,000 BIR Form 2316 issued by X Corp. (previous employer within the same year) Taxable compensation 120,000 Additional Information: Payroll slip (withholding tax withheld 46,000 by ABC Corp From July - Dec) How much is the Gross compensation income from the present employer of Harry? O c 250,500 TRAS

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock