Question: 40. Inventory may be valued on the tax return at the lower of cost or market unless A) replacement cost is higher than historical cost.

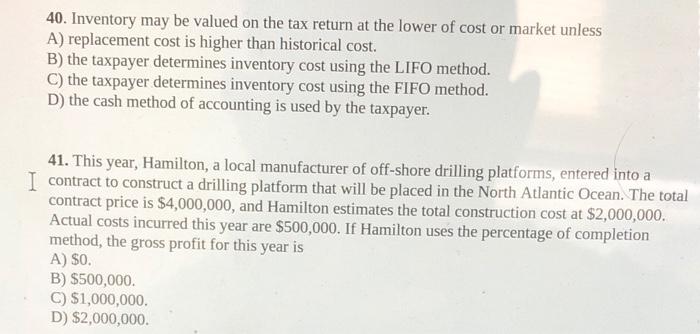

40. Inventory may be valued on the tax return at the lower of cost or market unless A) replacement cost is higher than historical cost. B) the taxpayer determines inventory cost using the LIFO method. C) the taxpayer determines inventory cost using the FIFO method. D) the cash method of accounting is used by the taxpayer. 41. This year, Hamilton, a local manufacturer of off-shore drilling platforms, entered into a I contract to construct a drilling platform that will be placed in the North Atlantic Ocean. The total contract price is $4,000,000, and Hamilton estimates the total construction cost at $2,000,000. Actual costs incurred this year are $500,000. If Hamilton uses the percentage of completion method, the gross profit for this year is A) $O. B) $500,000 C) $1,000,000 D) $2,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts