Question: (40 points). After a few weeks, the hedge fund Midterm Investment Partners LLC is back. Once again, you are trying to form a portfolio out

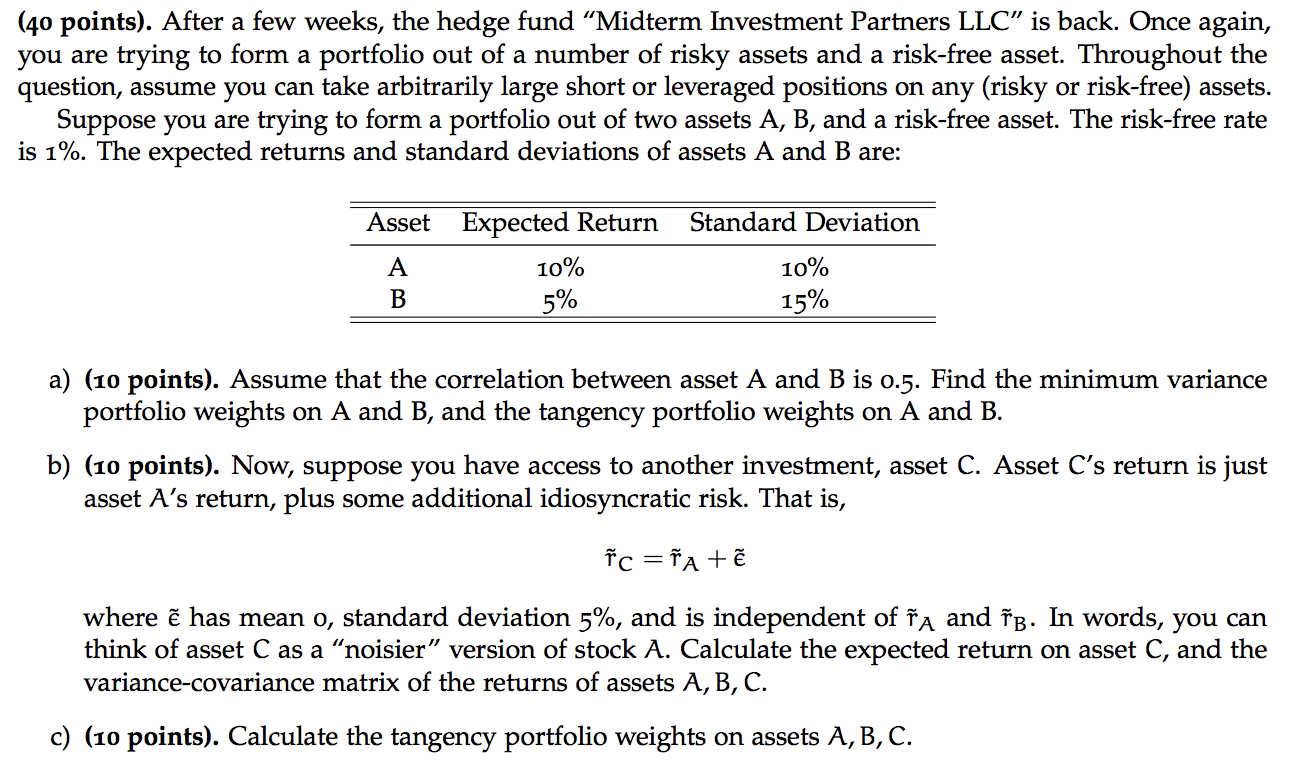

(40 points). After a few weeks, the hedge fund Midterm Investment Partners LLC is back. Once again, you are trying to form a portfolio out of a number of risky assets and a risk-free asset. Throughout the question, assume you can take arbitrarily large short or leveraged positions on any (risky or risk-free) assets. Suppose you are trying to form a portfolio out of two assets A, B, and a risk-free asset. The risk-free rate is 1%. The expected returns and standard deviations of assets A and B are: Standard Deviation Asset Expected Return A 10% B 5% 10% 15% a) (10 points). Assume that the correlation between asset A and B is 0.5. Find the minimum variance portfolio weights on A and B, and the tangency portfolio weights on A and B. b) (10 points). Now, suppose you have access to another investment, asset C. Asset C's return is just asset A's return, plus some additional idiosyncratic risk. That is, c =a + where has mean o, standard deviation 5%, and is independent of a and B. In words, you can think of asset C as a "noisier" version of stock A. Calculate the expected return on asset C, and the variance-covariance matrix of the returns of assets A, B, C. c) (10 points). Calculate the tangency portfolio weights on assets A, B,C. (40 points). After a few weeks, the hedge fund Midterm Investment Partners LLC is back. Once again, you are trying to form a portfolio out of a number of risky assets and a risk-free asset. Throughout the question, assume you can take arbitrarily large short or leveraged positions on any (risky or risk-free) assets. Suppose you are trying to form a portfolio out of two assets A, B, and a risk-free asset. The risk-free rate is 1%. The expected returns and standard deviations of assets A and B are: Standard Deviation Asset Expected Return A 10% B 5% 10% 15% a) (10 points). Assume that the correlation between asset A and B is 0.5. Find the minimum variance portfolio weights on A and B, and the tangency portfolio weights on A and B. b) (10 points). Now, suppose you have access to another investment, asset C. Asset C's return is just asset A's return, plus some additional idiosyncratic risk. That is, c =a + where has mean o, standard deviation 5%, and is independent of a and B. In words, you can think of asset C as a "noisier" version of stock A. Calculate the expected return on asset C, and the variance-covariance matrix of the returns of assets A, B, C. c) (10 points). Calculate the tangency portfolio weights on assets A, B,C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts