Brad forms Vott Corporation by contributing equipment, which has a basis of $50,000 and an FMV...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

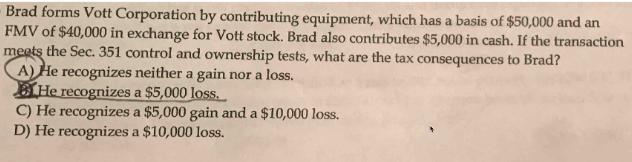

Brad forms Vott Corporation by contributing equipment, which has a basis of $50,000 and an FMV of $40,000 in exchange for Vott stock. Brad also contributes $5,000 in cash. If the transaction meets the Sec. 351 control and ownership tests, what are the tax consequences to Brad? A) He recognizes neither a gain nor a loss. He recognizes a $5,000 loss. C) He recognizes a $5,000 gain and a $10,000 loss. D) He recognizes a $10,000 loss. Brad forms Vott Corporation by contributing equipment, which has a basis of $50,000 and an FMV of $40,000 in exchange for Vott stock. Brad also contributes $5,000 in cash. If the transaction meets the Sec. 351 control and ownership tests, what are the tax consequences to Brad? A) He recognizes neither a gain nor a loss. He recognizes a $5,000 loss. C) He recognizes a $5,000 gain and a $10,000 loss. D) He recognizes a $10,000 loss.

Expert Answer:

Answer rating: 100% (QA)

According to the Section 351 of Internal Revenue Service IRS no t... View the full answer

Related Book For

Canadian Income Taxation planning and decision making

ISBN: 9781259094330

17th edition 2014-2015 version

Authors: Joan Kitunen, William Buckwold

Posted Date:

Students also viewed these accounting questions

-

What are the tax consequences to a corporation and its shareholder when that corporation declares a dividend but, instead of paying cash, distributes to the shareholder property that has a value...

-

What are the tax consequences to a partner who contributes liabilities that exceed the total basis of assets transferred to a new partnership in exchange for a partnership interest? How does your...

-

What are the tax consequences if a parent sells property to a child at a price that is less than the actual value of the property? What difference would it make if the property were simply gifted to...

-

Draw Lewis structures for the AsCl4+ and AsCl6- ions. What type of reaction (acidbase, oxidationreduction, or the like) is the following? 2AsCl5(g) AsCl4AsCl6(s)

-

Memo, a public limited company, owns 75% of the ordinary share capital of Random, a public limited company which is situated in a foreign country. Memo acquired Random on 1 May 2003 for 120 million...

-

How does an exclusive relationship between a plant and its pollinator benefit each partner? What are the risks of exclusive partnerships?

-

For each of the following sets of numbers, calculate a \(95 \%\) confidence interval for the mean \((\sigma\) known); before going through the steps in calculating the confidence interval, the sample...

-

A by- product of phosphate fertilizer production is pyrite waste, which contains arsenic and lead. From 1884 to 1906, seven phosphate fertilizer plants operated on a forty- three- acre operated on a...

-

You are tasked with predicting the occurrence of a binary event E. That is, = EUE, and ENE 0. Let p and 1-p denote your true probabilities for E and E, respectively. Let r and 1-r denote your...

-

The worksheet used to produce Figure 23.2 is on the authors web site. How does the loss distribution change when the loss severity has a beta distribution with upper bound of 5, lower bound of zero,...

-

Describe in detail all the traffic map flows ( coloured lines) from 7 am to 7 pm of North Shore, Auckland with the proper names where traffic is more, or less and write weather at that time Green:...

-

A metal sphere is grounded via a single wire. One end of a plastic rod is given a positive charge and held near the sphere. (a) If the ground wire is removed while the rod and sphere are near each...

-

(a) By what distance do two objects carrying \(1.0 \mathrm{C}\) of charge each have to be separated beforc the electric force exerted on each object is \(1.0 \mathrm{~N}\) ? (b) How much charge...

-

Eden Organics gives massages, facials, and organic body treatments. Last summer, another organic spa opened up in town. The supply curve for Eden Organics would shift in which direction? a. To the...

-

Did you encounter any challenges as you tried to reach a consensus about what structures and systems needed to be in place to make remote work successful? Explain.

-

Two particles 1 and 2, each carrying \(71 \mathrm{pC}\) of charge, are released from rest on a nonconducting, low-friction track. Particle 1 accelerates initially at \(7.0 \mathrm{~m} /...

-

A user creates a script called test-script.sh in his home directory. Then, he issues the following commands: cd ~ PATH= chmod u=rwx test-script.sh test-script.sh will the last command successfully...

-

The following items were displayed in the statement of affairs for Lubbock Company: Fully secured liabilities ......... $90,000 Partially secured liabilities ....... 12,000 Unsecured liabilities...

-

When net income from business for tax purposes is being determined, the timing of certain expense deductions is discretionary. For example, a taxpayer may claim all of, some of, or none of the...

-

TV Ltd. is a Canadian-controlled private corporation. The taxable income for its current year has been correctly calculated below. TV Ltd and Nano Ltd. are associated corporations. For the current...

-

An investment in capital property that appreciates in value at 10% per year is more valuable than an investment in capital property that provides an annual return, such as interest, of 10%. Explain...

-

Explain how the financial manager might use industry norms in the design of the companys financing mix.

-

You have developed the following income statement for Sing-Tel Corporation. It represents the most recent years operations, which ended yesterday. Your supervisor in the controllers office has just...

-

Financial data for three corporations are displayed here. MEASURE FIRM FIRM FIRM INDUSTRY A B C NORM Debt ratio 21% 24% 39% 21% Times interest 7.5 10.2 7.0 9.1 times earned times times times...

Study smarter with the SolutionInn App