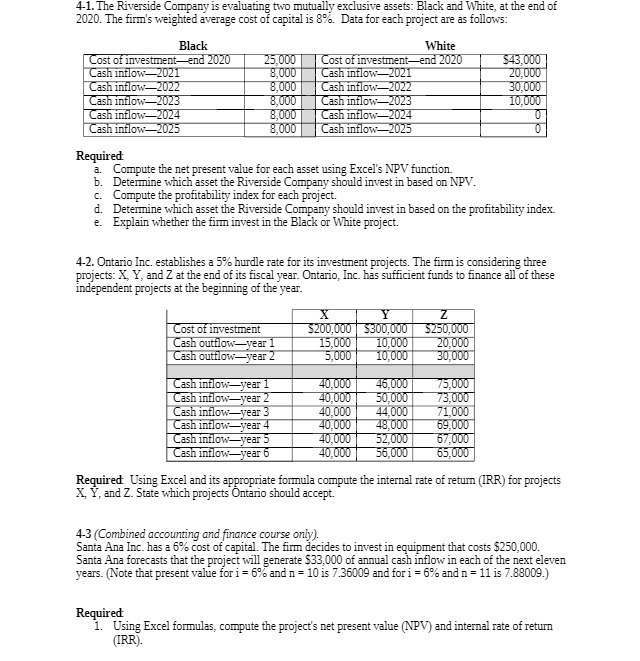

Question: 4-1. The Riverside Company is evaluating two mutually exclusive assets: Black and White, at the end of 2020. The firm's weighted average cost of capital

4-1. The Riverside Company is evaluating two mutually exclusive assets: Black and White, at the end of 2020. The firm's weighted average cost of capital is 8%. Data for each project are as follows: Black White Cost of investment-end 2020 25,000 Cost of investment-end 2020 $43,000 Cash inflow-2021 8,000 Cash inflow-2021 20,000 Cash inflow-2022 8,000 Cash inflow-2022 30,000 Cash inflow-2023 8,000 Cash inflow-2023 10,000 Cash inflow-2024 8,000 Cash inflow-2024 Cash inflow-2025 8,000 Cash inflow-2025 0 Required a. Compute the net present value for each asset using Excel's NPV function. Determine which asset the Riverside Company should invest in based on NPV. Compute the profitability index for each project. d. Determine which asset the Riverside Company should invest in based on the profitability index. Explain whether the firm invest in the Black or White project. 4-2. Ontario Inc. establishes a 5% hurdle rate for its investment projects. The firm is considering three projects: X, Y, and Z at the end of its fiscal year. Ontario, Inc. has sufficient funds to finance all of these independent projects at the beginning of the year. X Y Z Cost of investment $200,000 1 5300,000 $250,000 Cash outflow-year 1 15,000 10,000 20,000 Cash outflow-year 2 5,000 10,000 30,000 Lash inflow-year 1 40,000 46,000 75,000 Cash inflow-year 2 40,000 50,000 73,000 Cash inflow-year 3 40,000 44,000 71,000 Cash inflow-year 4 40,000 48,000 69,000 Cash inflow-year 5 40,000 52,000 67,000 Cash inflow-year 6 40,000 56,000 65,000 Required Using Excel and its appropriate formula compute the internal rate of return (IRR) for projects X, Y, and Z. State which projects Ontario should accept. 4-3 (Combined accounting and finance course only). Santa Ana Inc. has a 6% cost of capital. The firm decides to invest in equipment that costs $250,000. Santa Ana forecasts that the project will generate $33,000 of annual cash inflow in each of the next eleven years. (Note that present value for i = 6% and n = 10 is 7.36009 and for i = 6% and n = 11 is 7.88009.) Required 1. Using Excel formulas, compute the project's net present value (NPV) and internal rate of return (IRR)