Question: 4:48 ..1 5G O cdn.fbsbx.com Done K CLWM4100 Case Study Information (Assessment 2) Assessment Instructions This case study must be completed and submitted to Turnitin

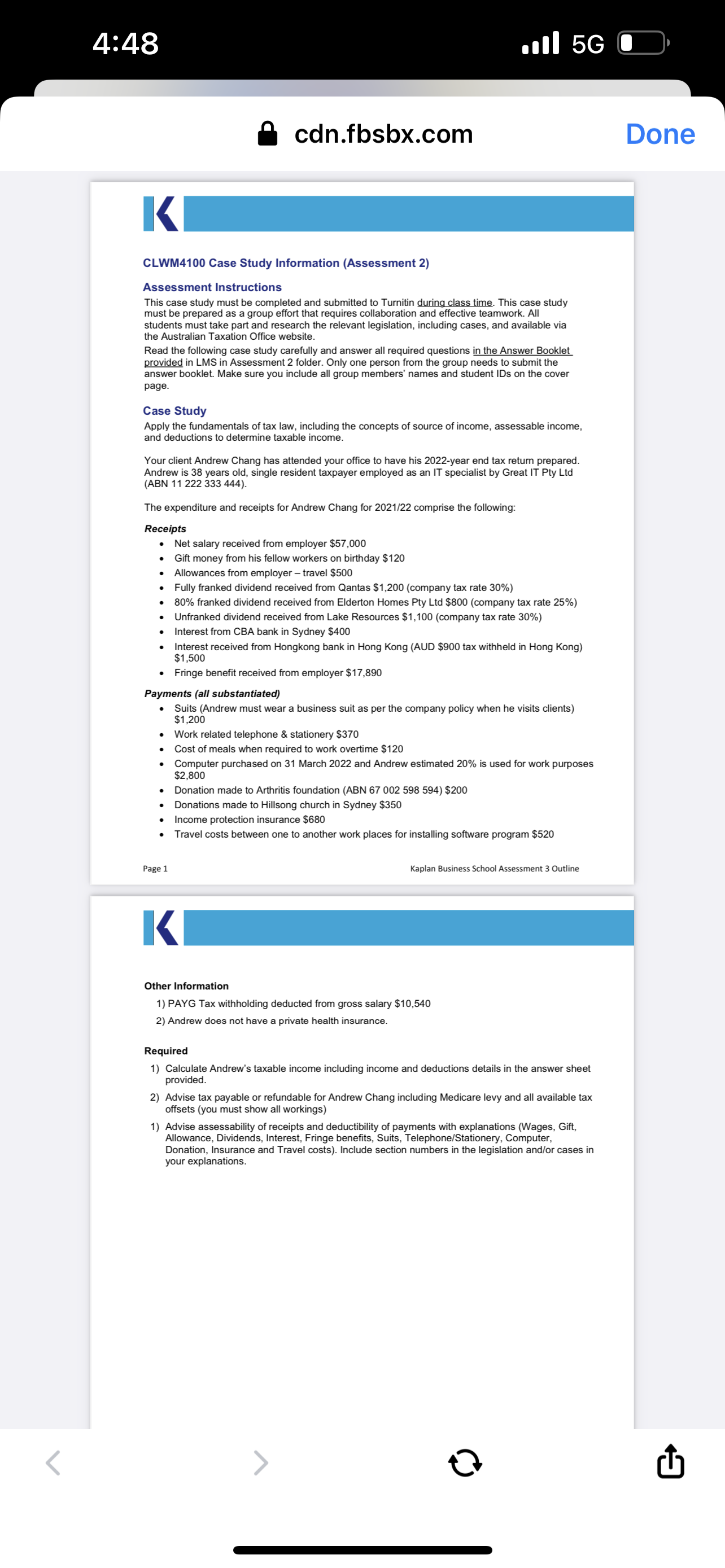

4:48 ..1 5G O cdn.fbsbx.com Done K CLWM4100 Case Study Information (Assessment 2) Assessment Instructions This case study must be completed and submitted to Turnitin during class time. This case study must be prepared as a group effort that requires collaboration and effective teamwork. All students must take part and research the relevant legislation, including cases, and available via the Australian Taxation Office website. Read the following case study carefully and answer all required questions in the Answer Booklet provided in LMS in Assessment 2 folder. Only one person from the group needs to submit the answer booklet. Make sure you include all group members' names and student IDs on the cover page. Case Study Apply the fundamentals of tax law, including the concepts of source of income, assessable income, and deductions to determine taxable income. Your client Andrew Chang has attended your office to have his 2022-year end tax return prepared. Andrew is 38 years old, single resident taxpayer employed as an IT specialist by Great IT Pty Ltd (ABN 11 222 333 444). The expenditure and receipts for Andrew Chang for 2021/22 comprise the following: Receipts . Net salary received from employer $57,000 Gift money from his fellow workers on birthday $120 . Allowances from employer - travel $500 . Fully franked dividend received from Qantas $1,200 (company tax rate 30%) 80% franked dividend received from Elderton Homes Pty Ltd $800 (company tax rate 25%) Unfranked dividend received from Lake Resources $1,100 (company tax rate 30%) . Interest from CBA bank in Sydney $400 . Interest received from Hongkong bank in Hong Kong (AUD $900 tax withheld in Hong Kong) $1,500 . Fringe benefit received from employer $17,890 Payments (all substantiated) Suits (Andrew must wear a business suit as per the company policy when he visits clients) $1,200 . Work related telephone

4:48 ..1 5G O cdn.fbsbx.com Done K CLWM4100 Case Study Information (Assessment 2) Assessment Instructions This case study must be completed and submitted to Turnitin during class time. This case study must be prepared as a group effort that requires collaboration and effective teamwork. All students must take part and research the relevant legislation, including cases, and available via the Australian Taxation Office website. Read the following case study carefully and answer all required questions in the Answer Booklet provided in LMS in Assessment 2 folder. Only one person from the group needs to submit the answer booklet. Make sure you include all group members' names and student IDs on the cover page. Case Study Apply the fundamentals of tax law, including the concepts of source of income, assessable income, and deductions to determine taxable income. Your client Andrew Chang has attended your office to have his 2022-year end tax return prepared. Andrew is 38 years old, single resident taxpayer employed as an IT specialist by Great IT Pty Ltd (ABN 11 222 333 444). The expenditure and receipts for Andrew Chang for 2021/22 comprise the following: Receipts . Net salary received from employer $57,000 Gift money from his fellow workers on birthday $120 . Allowances from employer - travel $500 . Fully franked dividend received from Qantas $1,200 (company tax rate 30%) 80% franked dividend received from Elderton Homes Pty Ltd $800 (company tax rate 25%) Unfranked dividend received from Lake Resources $1,100 (company tax rate 30%) . Interest from CBA bank in Sydney $400 . Interest received from Hongkong bank in Hong Kong (AUD $900 tax withheld in Hong Kong) $1,500 . Fringe benefit received from employer $17,890 Payments (all substantiated) Suits (Andrew must wear a business suit as per the company policy when he visits clients) $1,200 . Work related telephone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts