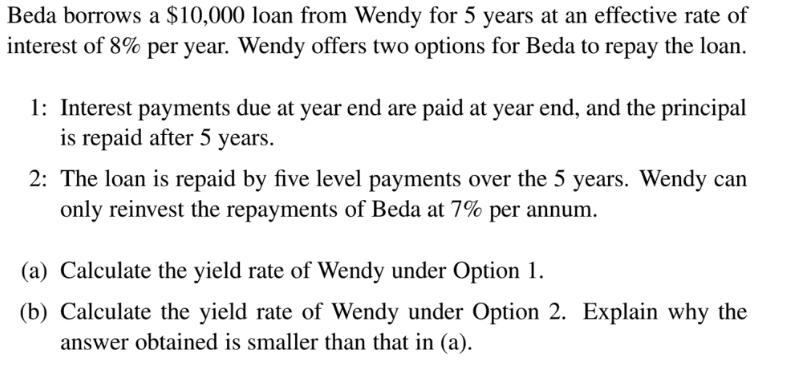

Question: Beda borrows a $10,000 loan from Wendy for 5 years at an effective rate of interest of 8% per year. Wendy offers two options

Beda borrows a $10,000 loan from Wendy for 5 years at an effective rate of interest of 8% per year. Wendy offers two options for Beda to repay the loan. 1: Interest payments due at year end are paid at year end, and the principal is repaid after 5 years. 2: The loan is repaid by five level payments over the 5 years. Wendy can only reinvest the repayments of Beda at 7% per annum. (a) Calculate the yield rate of Wendy under Option 1. (b) Calculate the yield rate of Wendy under Option 2. Explain why the answer obtained is smaller than that in (a). Beda borrows a $10,000 loan from Wendy for 5 years at an effective rate of interest of 8% per year. Wendy offers two options for Beda to repay the loan. 1: Interest payments due at year end are paid at year end, and the principal is repaid after 5 years. 2: The loan is repaid by five level payments over the 5 years. Wendy can only reinvest the repayments of Beda at 7% per annum. (a) Calculate the yield rate of Wendy under Option 1. (b) Calculate the yield rate of Wendy under Option 2. Explain why the answer obtained is smaller than that in (a). Beda borrows a $10,000 loan from Wendy for 5 years at an effective rate of interest of 8% per year. Wendy offers two options for Beda to repay the loan. 1: Interest payments due at year end are paid at year end, and the principal is repaid after 5 years. 2: The loan is repaid by five level payments over the 5 years. Wendy can only reinvest the repayments of Beda at 7% per annum. (a) Calculate the yield rate of Wendy under Option 1. (b) Calculate the yield rate of Wendy under Option 2. Explain why the answer obtained is smaller than that in (a).

Step by Step Solution

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Answer Detail Explanation iThe monthly payment is the payment that is paid at th... View full answer

Get step-by-step solutions from verified subject matter experts