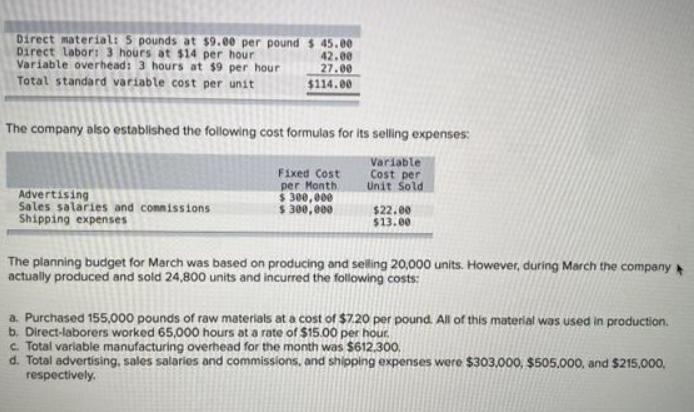

Question: $ 45.00 Direct material: 5 pounds at $9.00 per pound Direct labor: 3 hours at $14 per hour Variable overhead: 3 hours at $9

$ 45.00 Direct material: 5 pounds at $9.00 per pound Direct labor: 3 hours at $14 per hour Variable overhead: 3 hours at $9 per hour Total standard variable cost per unit 42.00 27.00 $114.00 The company also established the following cost formulas for its selling expenses: Fixed Cost per Month Variable Cost per Unit Sold Advertising Sales salaries and commissions Shipping expenses $ 300,000 $ 300,000 $22.00 $13.00 The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 24,800 units and incurred the following costs: a. Purchased 155,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production. b. Direct-laborers worked 65,000 hours at a rate of $15.00 per hour. c. Total variable manufacturing overhead for the month was $612,300, d. Total advertising, sales salaries and commissions, and shipping expenses were $303,000, $505,000, and $215,000, respectively. 13. What is the spending variance related to advertising? (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (l.e., zero variance.). Input the amount as a positive value.) Spending variance related to adversaing

Step by Step Solution

3.57 Rating (168 Votes )

There are 3 Steps involved in it

5 Material price variance 9720180000 3240... View full answer

Get step-by-step solutions from verified subject matter experts