Question: 46, 47, 48. Only need help with problem 48. Glossary. vestee company is 46. Asset acquisition vs. stock purchase (fair value equals book value) Assume

46, 47, 48.

Only need help with problem 48.

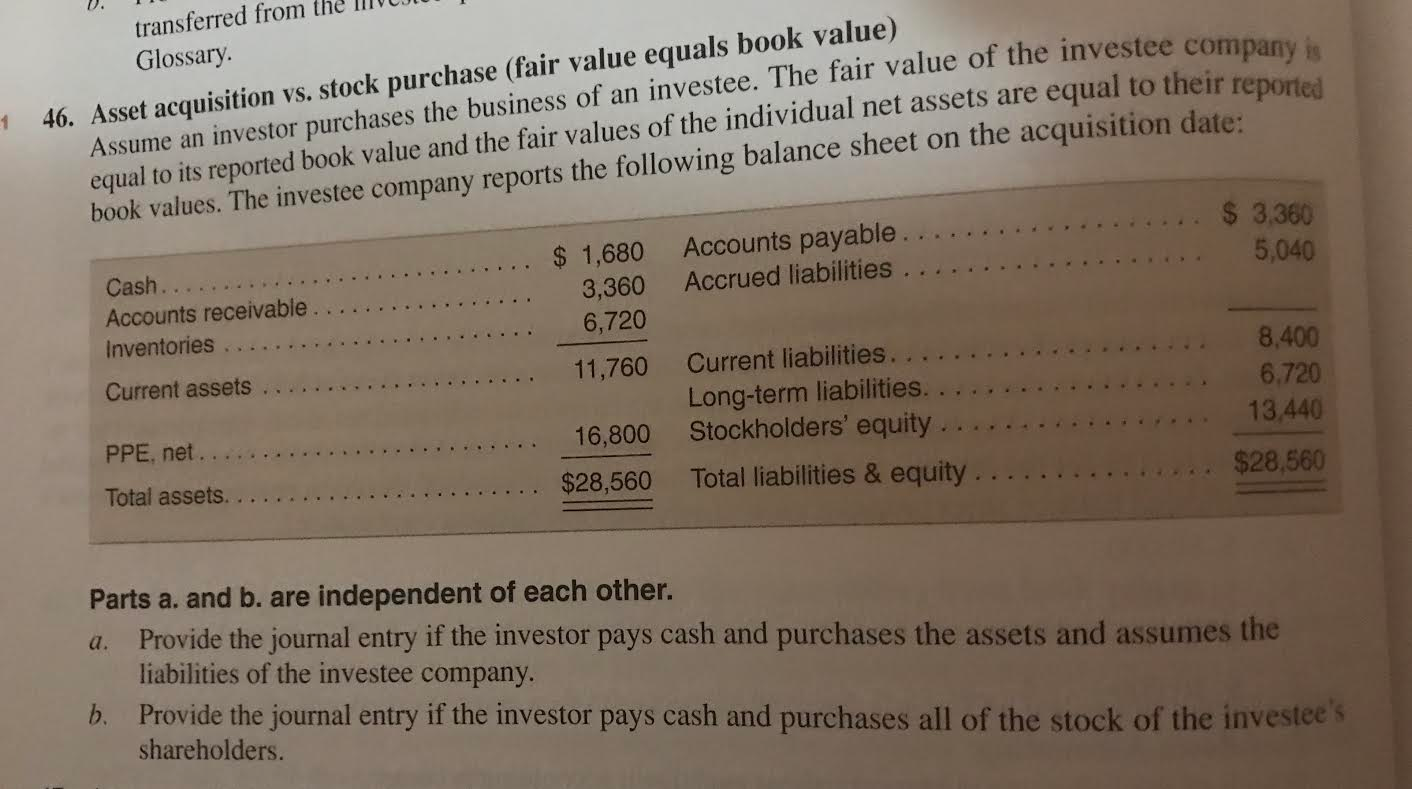

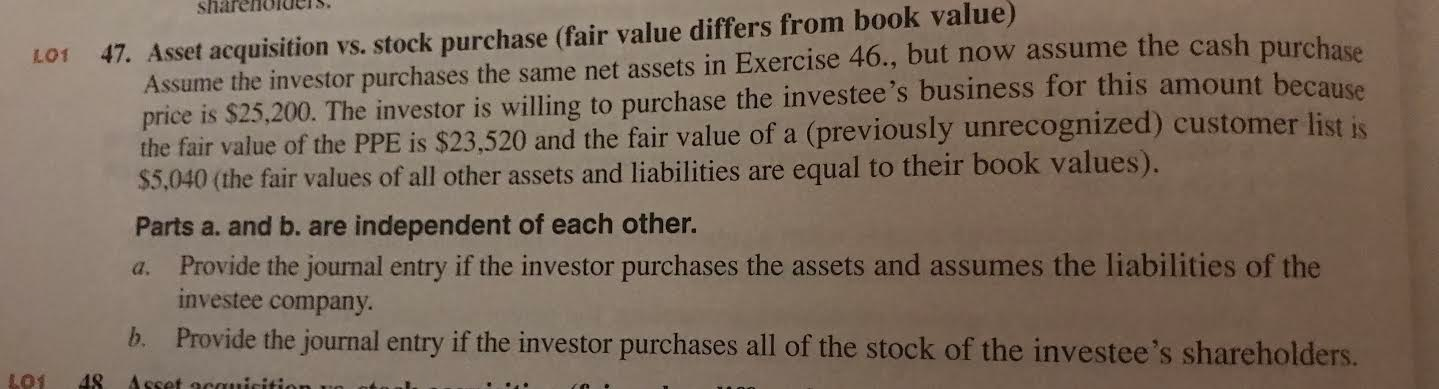

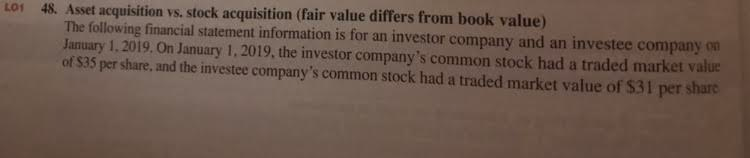

Glossary. vestee company is 46. Asset acquisition vs. stock purchase (fair value equals book value) Assume an investor purchases the business of an investee. The fair value of the investee com equal to its reported book value and the fair values of the individual net assets are equal to their ta book values. The investee company reports the following balance sheet on the acquisition date: Cash..... Accounts receivable. Teceivable ......... Inventories ... Accounts payable.................. $ 3,360 Accrued liabilities. $ 1,680 3,360 6,720 11,760 5,040 Current assets ... PPE, net.... 16,800 Current liabilities. ....... Long-term liabilities. .... Stockholders' equity ..... Total liabilities & equity ...... Total assets..... $28,560 8,400 6.720 13,440 $28,560 Parts a. and b. are independent of each other. a. Provide the journal entry if the investor pays cash and purchases the assets and assumes the liabilities of the investee company. b. Provide the journal entry if the investor pays cash and purchases all of the stock of the investee's shareholders. shareholdCIS. L01 47. Asset acquisition vs. stock purchase (fair value differs from book value) Assume the investor purchases the same net assets in Exercise 46., but now assume the cash purchase price is $25,200. The investor is willing to purchase the investee's business for this amount because the fair value of the PPE is $23,520 and the fair value of a (previously unrecognized) customer list is $5,040 (the fair values of all other assets and liabilities are equal to their book values). Parts a. and b. are independent of each other. Provide the journal entry if the investor purchases the assets and assumes the liabilities of the investee company. b. Provide the journal entry if the investor purchases all of the stock of the investee's shareholders. 48 Asset acquisition to anal LOL LO1 48. Asset acquisition vs. stock acquisition (fair value differs from book value) The following financial statement information is for an investor company and an investee company on January 1, 2019. On January 1, 2019, the investor company's common stock had a traded market value of $35 per share, and the investee company's common stock had a traded market value of $31 per sharo Glossary. vestee company is 46. Asset acquisition vs. stock purchase (fair value equals book value) Assume an investor purchases the business of an investee. The fair value of the investee com equal to its reported book value and the fair values of the individual net assets are equal to their ta book values. The investee company reports the following balance sheet on the acquisition date: Cash..... Accounts receivable. Teceivable ......... Inventories ... Accounts payable.................. $ 3,360 Accrued liabilities. $ 1,680 3,360 6,720 11,760 5,040 Current assets ... PPE, net.... 16,800 Current liabilities. ....... Long-term liabilities. .... Stockholders' equity ..... Total liabilities & equity ...... Total assets..... $28,560 8,400 6.720 13,440 $28,560 Parts a. and b. are independent of each other. a. Provide the journal entry if the investor pays cash and purchases the assets and assumes the liabilities of the investee company. b. Provide the journal entry if the investor pays cash and purchases all of the stock of the investee's shareholders. shareholdCIS. L01 47. Asset acquisition vs. stock purchase (fair value differs from book value) Assume the investor purchases the same net assets in Exercise 46., but now assume the cash purchase price is $25,200. The investor is willing to purchase the investee's business for this amount because the fair value of the PPE is $23,520 and the fair value of a (previously unrecognized) customer list is $5,040 (the fair values of all other assets and liabilities are equal to their book values). Parts a. and b. are independent of each other. Provide the journal entry if the investor purchases the assets and assumes the liabilities of the investee company. b. Provide the journal entry if the investor purchases all of the stock of the investee's shareholders. 48 Asset acquisition to anal LOL LO1 48. Asset acquisition vs. stock acquisition (fair value differs from book value) The following financial statement information is for an investor company and an investee company on January 1, 2019. On January 1, 2019, the investor company's common stock had a traded market value of $35 per share, and the investee company's common stock had a traded market value of $31 per sharo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts