Question: 46. Mary Beth is a CPA, devoting 3,000 hours per year to her practice. She also owns an office building in which she rents out

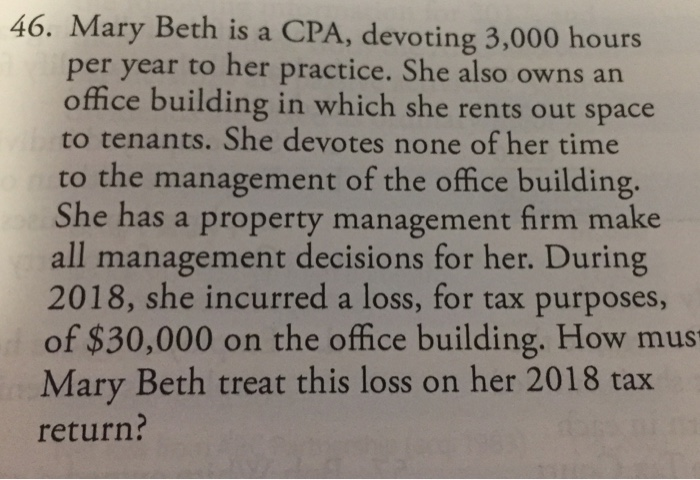

46. Mary Beth is a CPA, devoting 3,000 hours per year to her practice. She also owns an office building in which she rents out space to tenants. She devotes none of her time to the management of the office building She has a property management firm make management decisions for her. During 2018, she incurred a loss, for tax purposes, of $30,000 on the office building. How mus Mary Beth treat this loss on her 2018 tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts