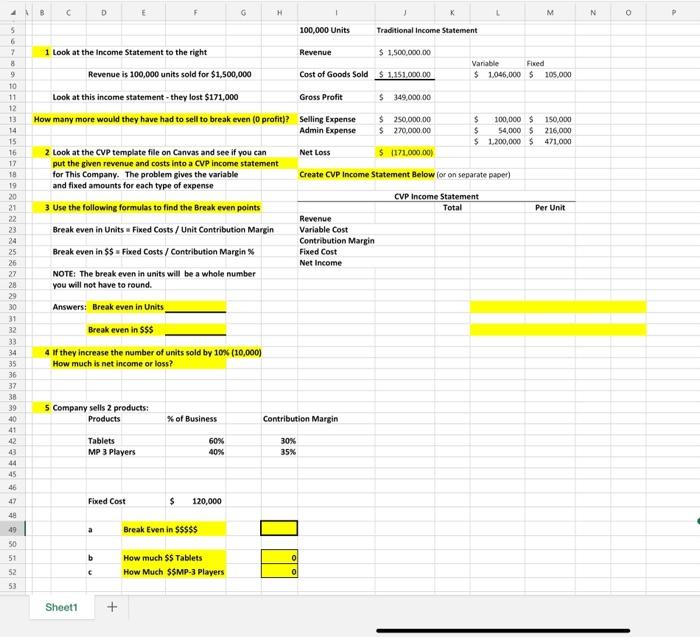

Question: 48 D E K L M N 0 100,000 Units Traditional Income Statement Variable Fixed $ 1,046,000 $ 205,000 1 Look at the Income Statement

48 D E K L M N 0 100,000 Units Traditional Income Statement Variable Fixed $ 1,046,000 $ 205,000 1 Look at the Income Statement to the right Revenue $ 1,500,000.00 Revenue is 100,000 units sold for $1,500,000 Cost of Goods Sold $ 1,151,000.00 Look at this income statement - they lost $171,000 Gross Profit $ 349,000.00 How many more would they have had to sell to break even (profit)? Selling Expense $ 250,000.00 Admin Expense 270,000.00 $ $ 100,000 $ 150.000 $ 54,000 $ 216.000 $ 1.200,000 $471.000 Net Loss $ 1171.000.00) Create CVP Income Statement Below for on separate paper) CVP Income Statement Total Per Unit 5 6 7 8 9 10 11 12 13 14 15 16 12 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 2 Look at the CVP template file on Canvas and see if you can put the given revenue and costs into a CVP income statement for This Company. The problem gives the variable and fixed amounts for each type of expense 3 Use the following formulas to find the Break even points Break even in Units a Fixed Costs / Unit Contribution Margin Break even in SS Fixed Costs / Contribution Margin NOTE: The break even in units will be a whole number you will not have to round. Answers: Break even in Units Break even in $5$ 4 if they increase the number of units sold by 10% (10,000) How much is net income or loss? Revenue Variable Cost Contribution Margin Fixed Cost Net Income 5 Company sells 2 products: Products % of Business Contribution Margin Tablets MP3 Players 60% 40% 30% 35% 46 47 Fixed Cost $ 120,000 48 49 a Break Even in $$$$$ 50 b 0 51 52 53 How much SS Tablets How Much SSMP-3 Players c 0 Sheet1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts