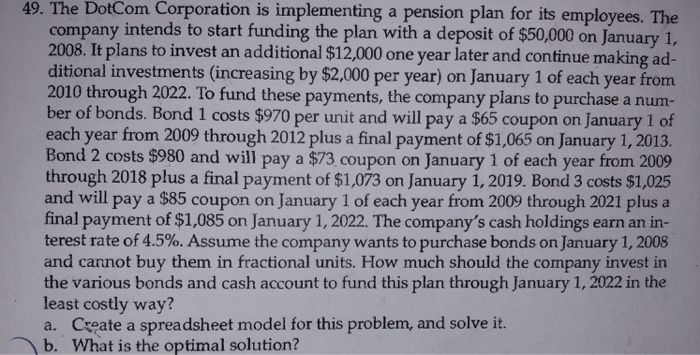

Question: 49. The DotCom Corporation is implementing a pension plan for its employees. The company intends to start funding the plan with a deposit of $50,000

49. The DotCom Corporation is implementing a pension plan for its employees. The company intends to start funding the plan with a deposit of $50,000 on January 1, 2008. It plans to invest an additional $12,000 one year later and continue making ad- ditional investments (increasing by $2,000 per year) on January 1 of each year from 2010 through 2022. To fund these payments, the company plans to purchase a num- ber of bonds. Bond 1 costs $970 per unit and will pay a $65 coupon on January 1 of each year from 2009 through 2012 plus a final payment of $1,065 on January 1, 2013. Bond 2 costs $980 and will pay a $73 coupon on January 1 of each year from 2009 through 2018 plus a final payment of $1,073 on January 1, 2019. Bond 3 costs $1,025 and will pay a $85 coupon on January 1 of each year from 2009 through 2021 plus a final payment of $1,085 on January 1, 2022. The company's cash holdings earn an in- terest rate of 4.5%. Assume the company wants to purchase bonds on January 1, 2008 and cannot buy them in fractional units. How much should the company invest in the various bonds and cash account to fund this plan through January 1, 2022 in the least costly way? a. Create a spreadsheet model for this problem, and solve it. b. What is the optimal solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts