Question: The Dotcom Corporation is implementing a pension plan for its emplayees. The compuny intends to start funding the plan with a deposit of $50,000 on

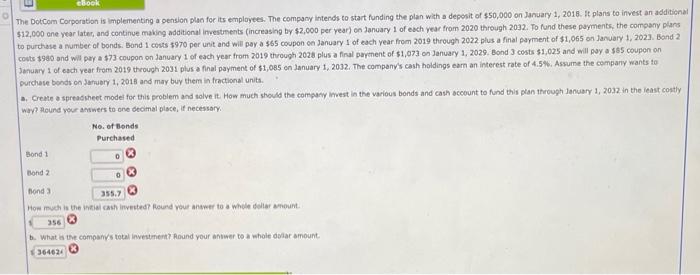

The Dotcom Corporation is implementing a pension plan for its emplayees. The compuny intends to start funding the plan with a deposit of $50,000 on January 1,2016 . it plans to invest an additional $12,000 one year lates, and continue making additional investments (increashp by $2,000 per year) co danuary 1 of each year from 2020 through 2032 . To fund these payments, the company plars to purchase a number of bonds. Band 1 costs $970 per unit and will pay a $55 coupon on January 1 of each year from 2019 through 2022 plus a final payment of $1,065 on january 1 , 2023 . Band 2 couts 1980 and will per a $73 coupon on lanuary 1 of each year from 2019 through 2028 plus a firal payenent of $1,073 on January 1,2029 . Bond 3 costs $1,025 and will pay a $55 coupen on Jenuary 1 of each year from 2019 through 2031 plus a final payment of $1,085 on zanuary 1,2032 . The companys cash hoidings earn an interest rate of 4.5%. Assume the company wants to purchuse bonds on Jartuary 1,2018 and may buy them in fractional units. a. Creme a spreassheet model for this problem and solve it How much stould the company imest in the various bonds and cash account to fund this plan through lanuary 1 , 2032 in the ieast coitly wapt fleund your answers to one decimal plsce, if necessary. (3) b. What is the companys total investment flound your answer to a whole dolat amount. The Dotcom Corporation is implementing a pension plan for its emplayees. The compuny intends to start funding the plan with a deposit of $50,000 on January 1,2016 . it plans to invest an additional $12,000 one year lates, and continue making additional investments (increashp by $2,000 per year) co danuary 1 of each year from 2020 through 2032 . To fund these payments, the company plars to purchase a number of bonds. Band 1 costs $970 per unit and will pay a $55 coupon on January 1 of each year from 2019 through 2022 plus a final payment of $1,065 on january 1 , 2023 . Band 2 couts 1980 and will per a $73 coupon on lanuary 1 of each year from 2019 through 2028 plus a firal payenent of $1,073 on January 1,2029 . Bond 3 costs $1,025 and will pay a $55 coupen on Jenuary 1 of each year from 2019 through 2031 plus a final payment of $1,085 on zanuary 1,2032 . The companys cash hoidings earn an interest rate of 4.5%. Assume the company wants to purchuse bonds on Jartuary 1,2018 and may buy them in fractional units. a. Creme a spreassheet model for this problem and solve it How much stould the company imest in the various bonds and cash account to fund this plan through lanuary 1 , 2032 in the ieast coitly wapt fleund your answers to one decimal plsce, if necessary. (3) b. What is the companys total investment flound your answer to a whole dolat amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts