Question: 4G 1 6:18 4 9 2.70 79% KB/S Task 2 Direction: Compute for the withholding tax for weekly wage earners. Write your computation in your

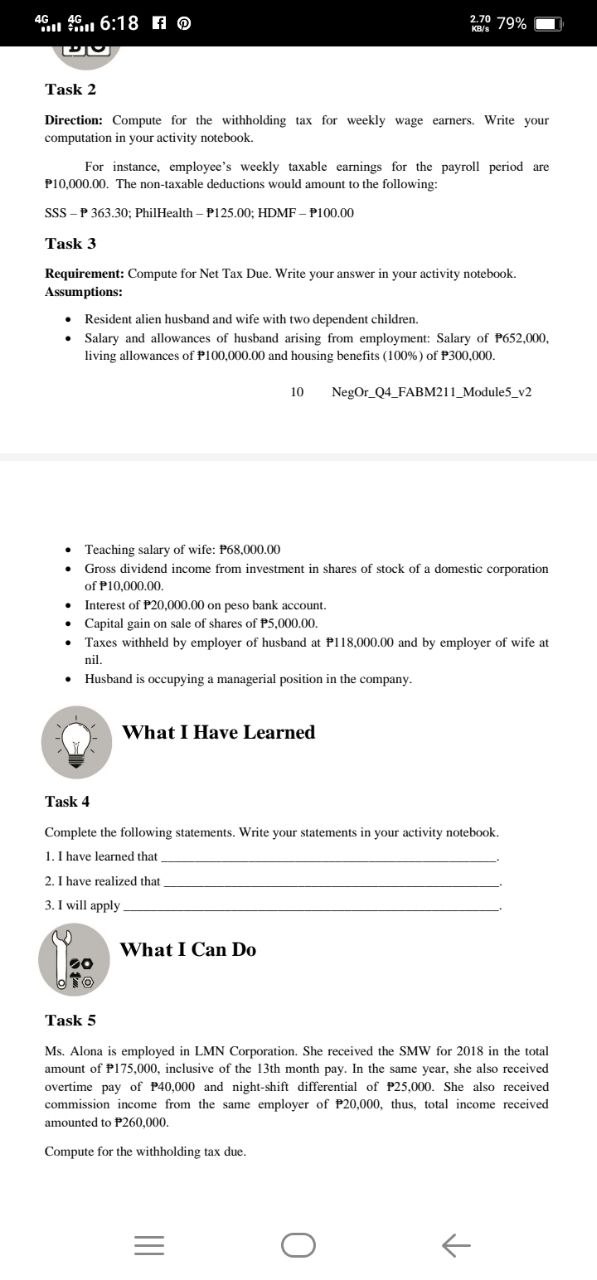

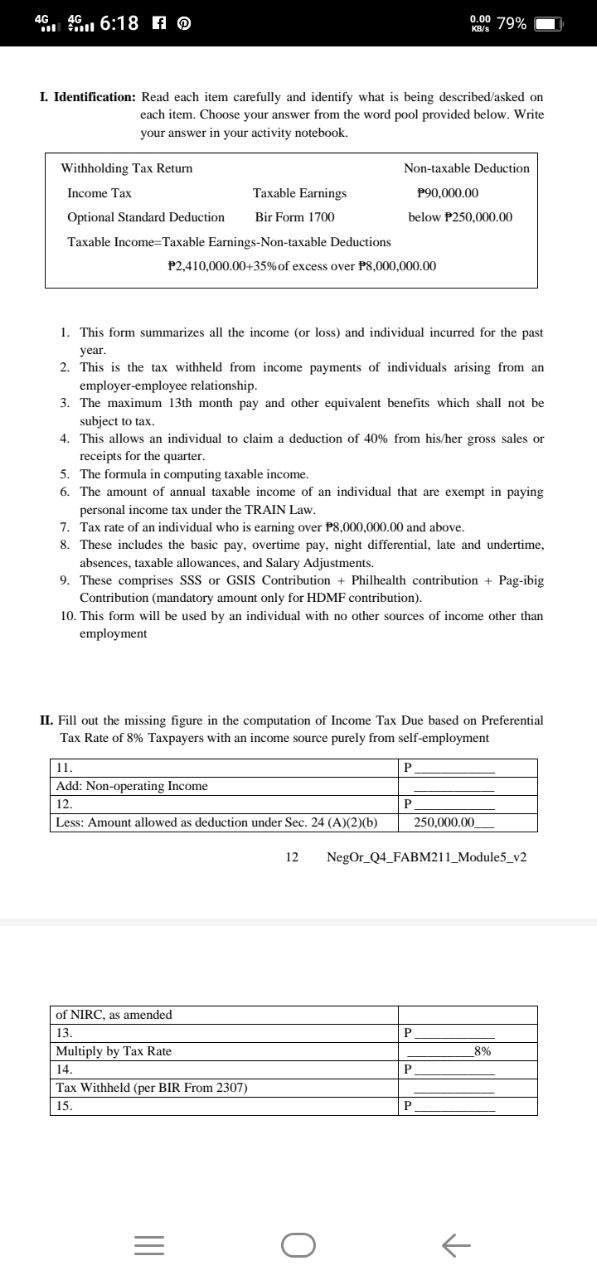

4G 1 6:18 4 9 2.70 79% KB/S Task 2 Direction: Compute for the withholding tax for weekly wage earners. Write your computation in your activity notebook. For instance, employee's weekly taxable earnings for the payroll period are P10,000.00. The non-taxable deductions would amount to the following: SSS - P 363.30; PhilHealth - P125.00; HDMF - P100.00 Task 3 Requirement: Compute for Net Tax Due. Write your answer in your activity notebook. Assumptions: Resident alien husband and wife with two dependent children. Salary and allowances of husband arising from employment: Salary of P652,000, living allowances of P100,000.00 and housing benefits (100% ) of P300,000. 10 NegOr_Q4_FABM211_Module5_v2 . Teaching salary of wife: P68,000.00 . Gross dividend income from investment in shares of stock of a domestic corporation of P10,000.00. Interest of P20,000.00 on peso bank account. Capital gain on sale of shares of P5,000.00. . Taxes withheld by employer of husband at P1 18,000.00 and by employer of wife at nil. Husband is occupying a managerial position in the company. What I Have Learned Task 4 Complete the following statements. Write your statements in your activity notebook. 1. I have learned that 2. I have realized that 3. I will apply What I Can Do O To Task 5 Ms. Alona is employed in LMN Corporation. She received the SMW for 2018 in the total amount of P175,000, inclusive of the 13th month pay. In the same year, she also received overtime pay of P40,000 and night-shift differential of P25,000. She also received commission income from the same employer of P20,000, thus, total income received amounted to P260,000. Compute for the withholding tax due. E O4G n 6:18 f @ 0.00 79% I. Identification: Read each item carefully and identify what is being described/asked on each item. Choose your answer from the word pool provided below. Write your answer in your activity notebook. Withholding Tax Return Non-taxable Deduction Income Tax Taxable Earnings P90,000.00 Optional Standard Deduction Bir Form 1700 below P250,000.00 Taxable Income=Taxable Earnings-Non-taxable Deductions P2,410,000.00+35% of excess over P8,000,000.00 1. This form summarizes all the income (or loss) and individual incurred for the past year. 2. This is the tax withheld from income payments of individuals arising from an employer-employee relationship. 3. The maximum 13th month pay and other equivalent benefits which shall not be subject to tax. 4. This allows an individual to claim a deduction of 40% from his/her gross sales or receipts for the quarter. 5. The formula in computing taxable income. 6. The amount of annual taxable income of an individual that are exempt in paying personal income tax under the TRAIN Law. 7. Tax rate of an individual who is earning over P8,000.000.00 and above. 8. These includes the basic pay, overtime pay, night differential, late and undertime, absences, taxable allowances, and Salary Adjustments. 9. These comprises SSS or GSIS Contribution + Philhealth contribution + Pag-ibig Contribution (mandatory amount only for HDMF contribution). 10. This form will be used by an individual with no other sources of income other than employment II. Fill out the missing figure in the computation of Income Tax Due based on Preferential Tax Rate of 8% Taxpayers with an income source purely from self-employment 11. P Add: Non-operating Income 12. P Less: Amount allowed as deduction under Sec. 24 (A)(2)(b) 250,000.00 12 NegOr_Q4_FABM211_Module5_v2 of NIRC, as amended 13. P Multiply by Tax Rate 8% 14. P Tax Withheld (per BIR From 2307) 15 P O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts