Question: 4.The Morningstar risk adjusted return uniquely differs from other performance indicators in terms of A) measuring realized excess returns B) measure of in investor risk

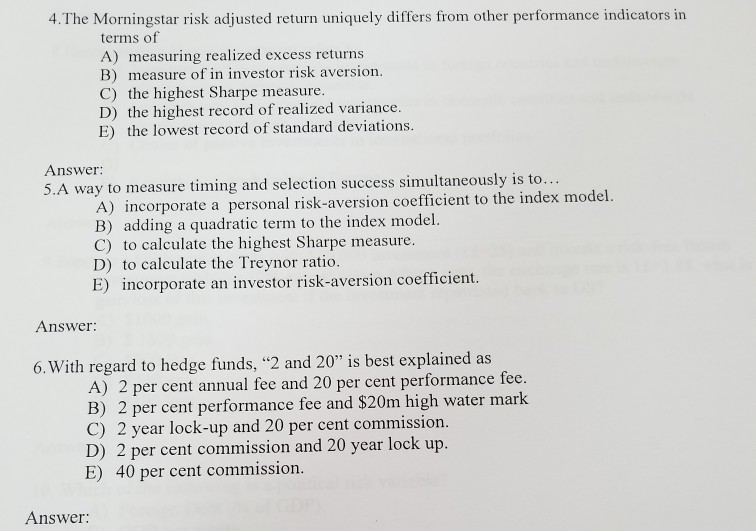

4.The Morningstar risk adjusted return uniquely differs from other performance indicators in terms of A) measuring realized excess returns B) measure of in investor risk aversion. C) the highest Sharpe measure. the highest record of realized variance the lowest record of standard deviations. E) Answer: 5.A way to measure timing and selection success simultaneously is to incorporate a personal risk-aversion coefficient to the index model. B) adding a quadratic term to the index model. C) to calculate the highest Sharpe measure. D) to calculate the Treynor ratio. E) incorporate an investor risk-aversion coefficient. Answer: 6. With regard to hedge funds, "2 and 20" is best explained as A) 2 per cent annual fee and 20 per cent performance fec. B) 2 per cent performance fee and $20m high water mark C) 2 year lock-up and 20 per cent commission. D) 2 per cent commission and 20 year lock up. E) 40 per cent commission

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts