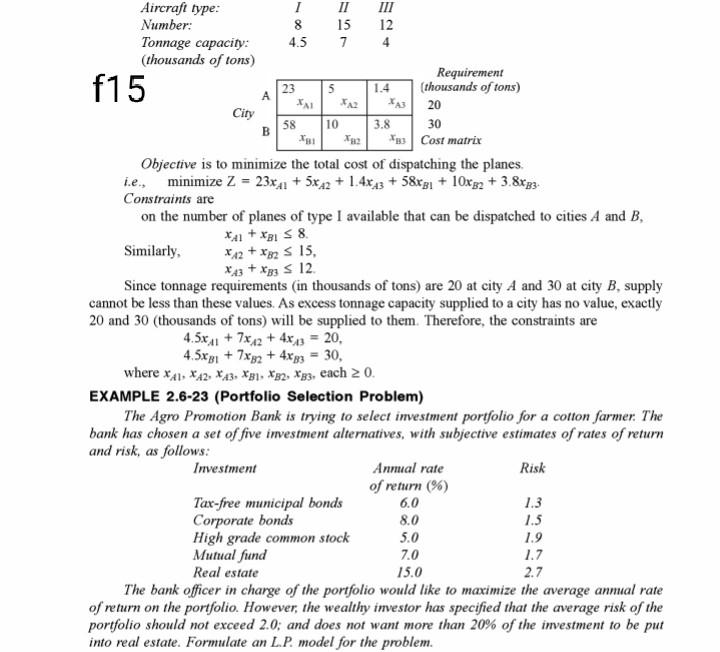

Question: 5 1.4 *1 E Aircraft type: 1 II III Number: 8 15 12 Tonnage capacity: 4.5 7 4 (thousands of tons) Requirement f15 23 (thousands

5 1.4 *1 E Aircraft type: 1 II III Number: 8 15 12 Tonnage capacity: 4.5 7 4 (thousands of tons) Requirement f15 23 (thousands of tons) 20 City 58 10 3.8 30 *33 Cost matrix Objective is to minimize the total cost of dispatching the planes. i.e. minimize Z = 23x1 + 5x42 + 1.4x 23 + 58x51 + 10x82 + 3.8%B3- Constraints are on the number of planes of type I available that can be dispatched to cities A and B, X1 + XB58 Similarly, *12+ 482 15, * 13 + xy S 12 Since tonnage requirements (in thousands of tons) are 20 at city A and 30 at city B, supply cannot be less than these values. As excess tonnage capacity supplied to a city has no value, exactly 20 and 30 (thousands of tons) will be supplied to them. Therefore, the constraints are 4.5x21 + 7x12 + 4x = 20, 4.5x81 + 7xg2 + 4x33 = 30, where XA1, X12, XA3, XB1, 82, 83, each 20. EXAMPLE 2.6-23 (Portfolio Selection Problem) The Agro Promotion Bank is trying to select investment portfolio for a cotton farmer. The bank has chosen a set of five investment alternatives, with subjective estimates of rates of return and risk, as follows: Investment Annual rate Risk of return (%) Tax-free municipal bonds 6.0 1.3 Corporate bonds 8.0 1.5 High grade common stock 5.0 1.9 Mutual fund 7.0 1.7 Real estate 15.0 2.7 The bank officer in charge of the portfolio would like to maximize the average annual rate of return on the portfolio. However, the wealthy investor has specified that the average risk of the portfolio should not exceed 2.0; and does not want more than 20% of the investment to be put into real estate. Formulate an L.P. model for the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock