Question: 5 18 Question 33 (3.03 points) E&Y (a U.S. based firm) negotiates a conditional currency call options with a bank to hedge its accounts payable

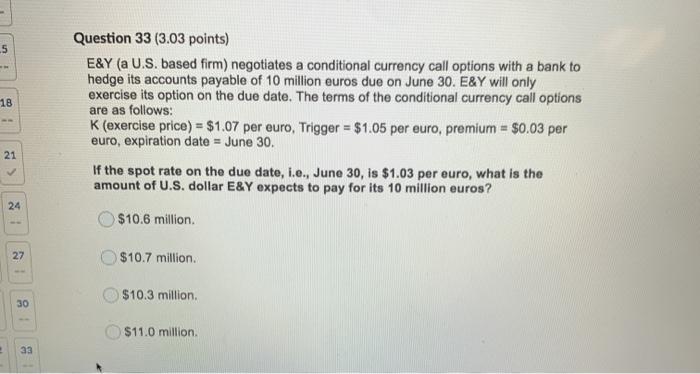

5 18 Question 33 (3.03 points) E&Y (a U.S. based firm) negotiates a conditional currency call options with a bank to hedge its accounts payable of 10 million euros due on June 30. E&Y will only exercise its option on the due date. The terms of the conditional currency call options are as follows: K(exercise price) = $1.07 per euro, Trigger = $1.05 per euro, premium - $0.03 per euro, expiration date = June 30. If the spot rate on the due date, i.e., June 30, is $1.03 per euro, what is the amount of U.S. dollar E&Y expects to pay for its 10 million euros? 21 24 $10.6 million 27 $10.7 million $10.3 million 30 $11.0 million. aa

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock