Question: Clorox (a U.S. based firm) negotiates a conditional currency call options with a bank to hedge its accounts payable of 8 million Turkish liras due

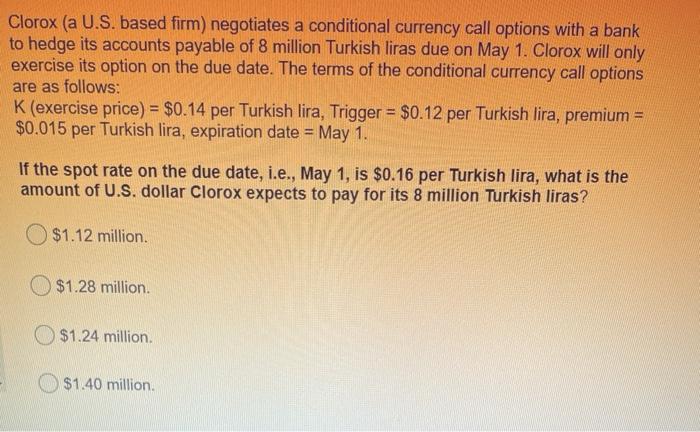

Clorox (a U.S. based firm) negotiates a conditional currency call options with a bank to hedge its accounts payable of 8 million Turkish liras due on May 1. Clorox will only exercise its option on the due date. The terms of the conditional currency call options are as follows: K(exercise price) = $0.14 per Turkish lira, Trigger = $0.12 per Turkish lira, premium $0.015 per Turkish lira, expiration date = May 1. If the spot rate on the due date, i.e., May 1, is $0.16 per Turkish lira, what is the amount of U.S. dollar Clorox expects to pay for its 8 million Turkish liras? $1.12 million. $1.28 million $1.24 million $1.40 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts