Question: 5. (20 points) The Expectations Theory: Applications Suppose that the current interest rates of bonds with a maturity of one to four years are given

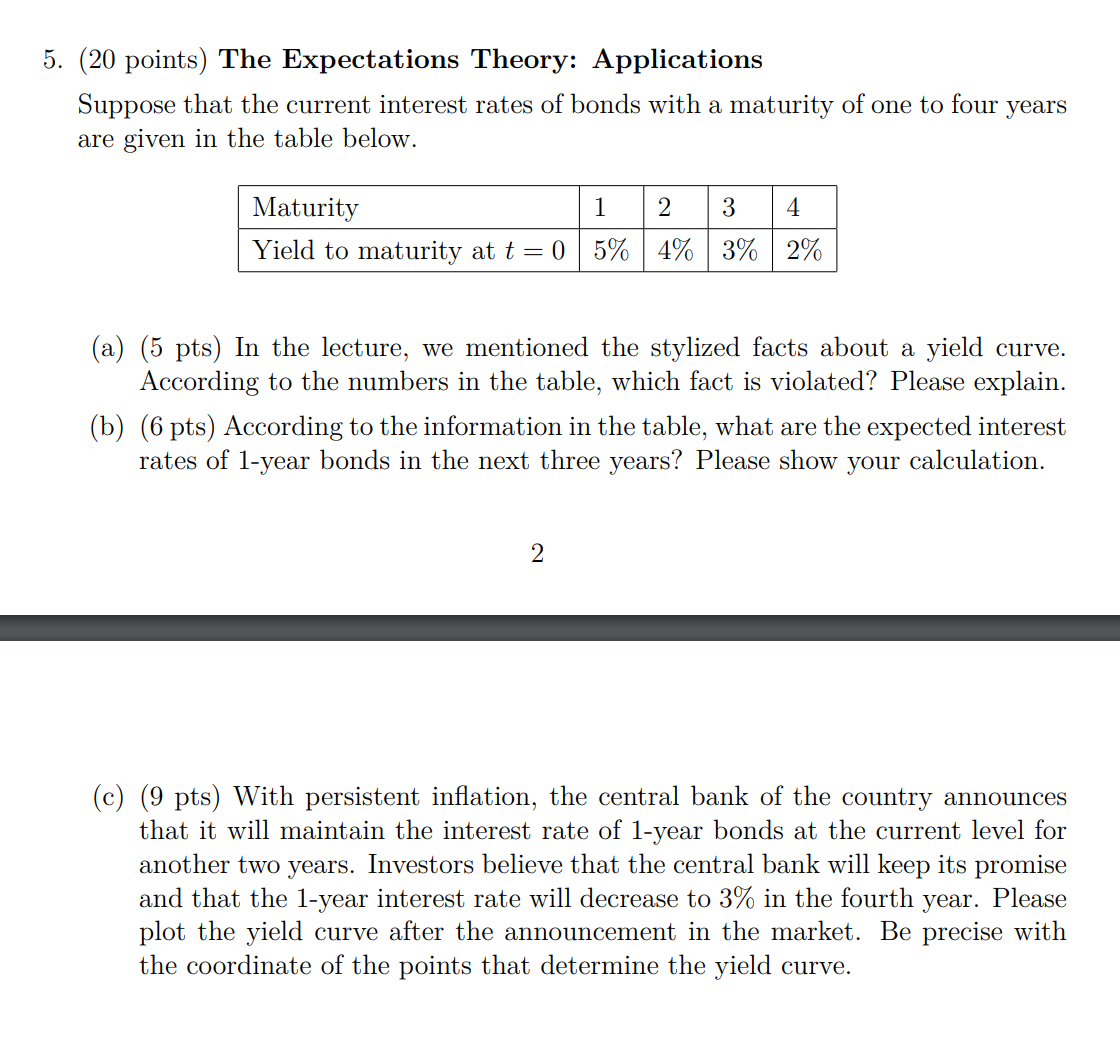

5. (20 points) The Expectations Theory: Applications Suppose that the current interest rates of bonds with a maturity of one to four years are given in the table below. (a) (5 pts) In the lecture, we mentioned the stylized facts about a yield curve. According to the numbers in the table, which fact is violated? Please explain. (b) (6 pts) According to the information in the table, what are the expected interest rates of 1 -year bonds in the next three years? Please show your calculation. 2 (c) (9 pts) With persistent inflation, the central bank of the country announces that it will maintain the interest rate of 1-year bonds at the current level for another two years. Investors believe that the central bank will keep its promise and that the 1-year interest rate will decrease to 3% in the fourth year. Please plot the yield curve after the announcement in the market. Be precise with the coordinate of the points that determine the yield curve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts