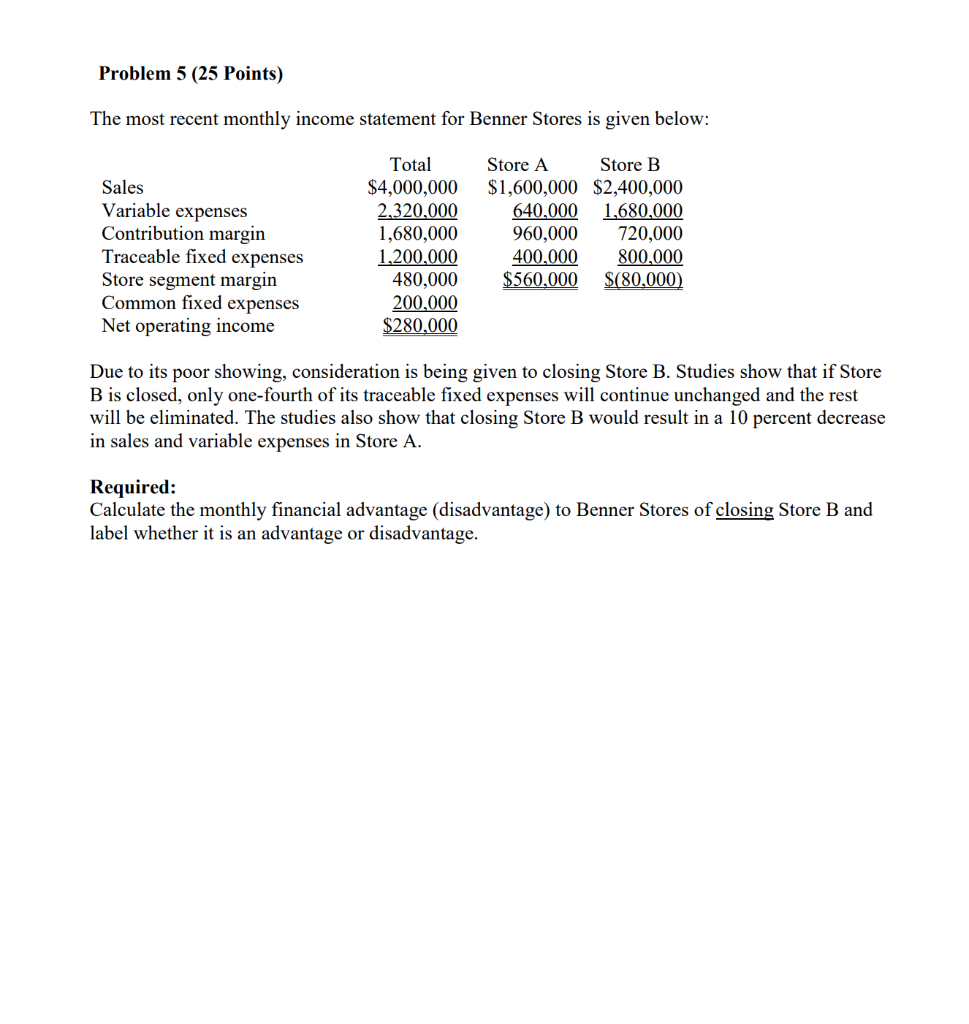

Question: 5 (25 Points) The most recent monthly income statement for Benner Stores is given below: Sales Total $4,000,000 Store A Store B $1,600,000 $2,400,000 Variable

5 (25 Points) The most recent monthly income statement for Benner Stores is given below: Sales Total $4,000,000 Store A Store B $1,600,000 $2,400,000 Variable expenses 2,320,000 640,000 1,680,000 Contribution margin 1,680,000 960,000 720,000 Traceable fixed expenses 1,200,000 400,000 800,000 Store segment margin 480,000 $560,000 $(80,000) Common fixed expenses 200,000 Net operating income $280,000 Due to its poor showing, consideration is being given to closing Store B. Studies show that if Store B is closed, only one-fourth of its traceable fixed expenses will continue unchanged and the rest will be eliminated. The studies also show that closing Store B would result in a 10 percent decrease in sales and variable expenses in Store A. Required: Calculate the monthly financial advantage (disadvantage) to Benner Stores of closing Store B and label whether it is an advantage or disadvantage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts