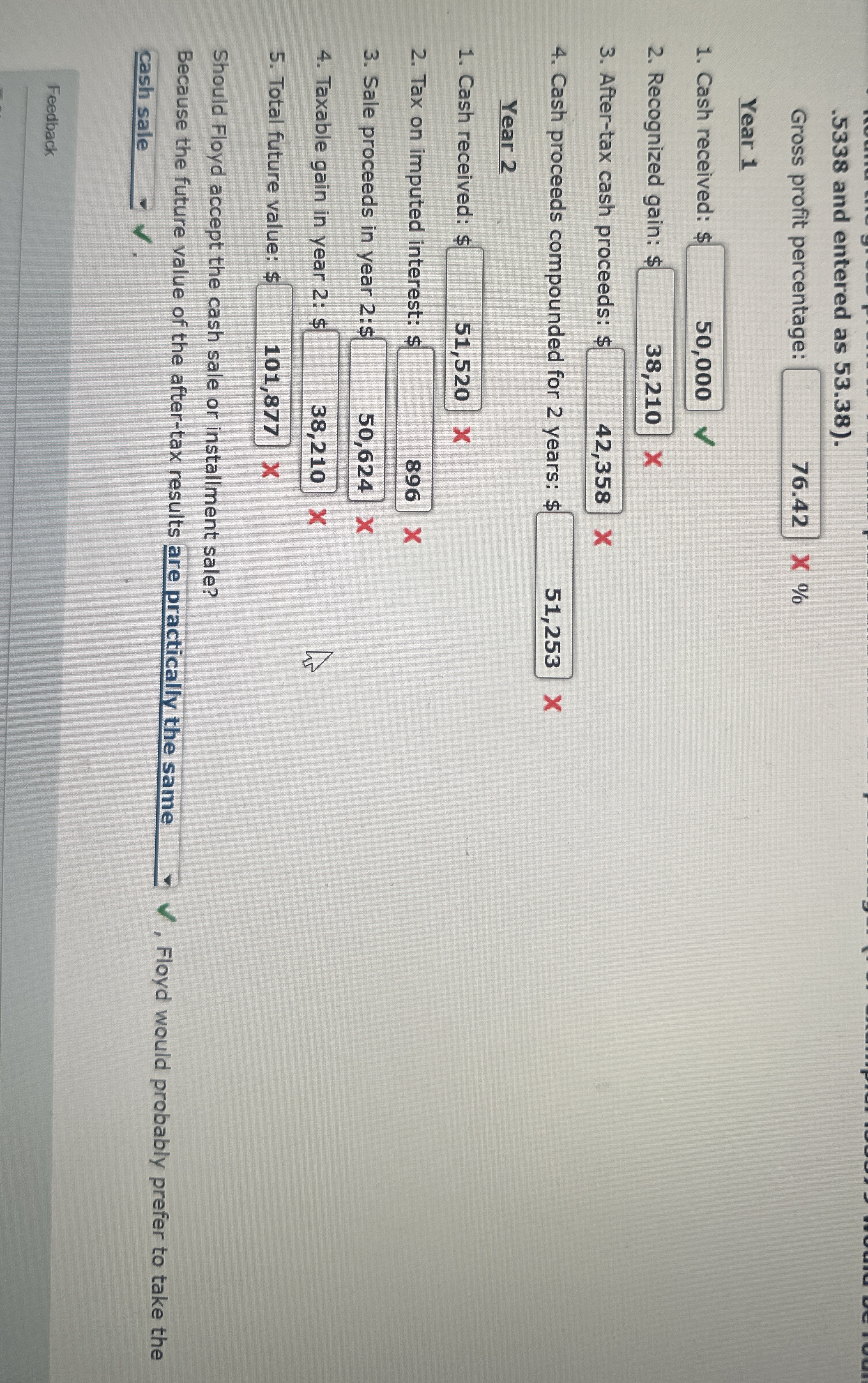

Question: . 5 3 3 8 and entered as 5 3 . 3 8 ) . Gross profit percentage: 7 6 . 4 2 % Year

and entered as

Gross profit percentage:

Year

Cash received: $

Recognized gain: s

Aftertax cash proceeds: $

Cash proceeds compounded for years: $

Year

Cash received: $ X

Tax on imputed interest: $

Sale proceeds in year :$ X

Taxable gain in year :$

Total future value:

Should Floyd accept the cash sale or installment sale?

Because the future value of the aftertax results are practically the same Floyd would probably prefer to take the cash sale

Feedback

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock