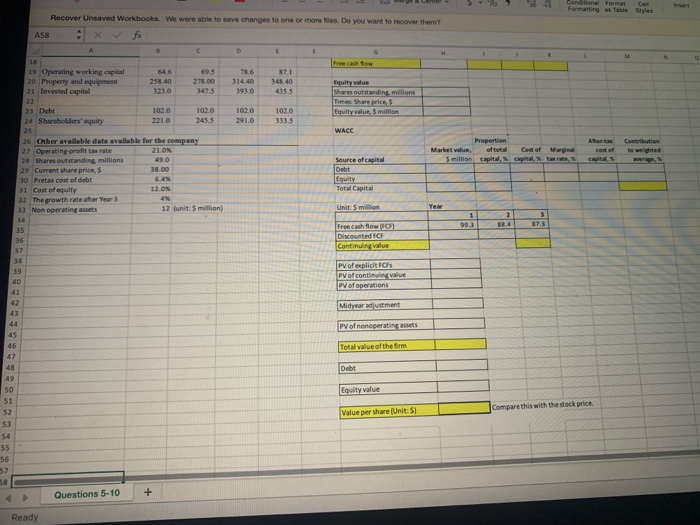

Question: 5. (3 points) Estimate the net operating profit less adjusted tax (NOPLAT) for Year 1, 2, and 3. 6. (6 points) Estimate the free cash

| 5. (3 points) Estimate the net operating profit less adjusted tax (NOPLAT) for Year 1, 2, and 3. | ||

| 6. (6 points) Estimate the free cash flow (FCF) for Year 1, 2, and 3. |

| |

| 7. (7 points) Compute the weighted average cost of capital (WACC). |

| |

| 8. (4 points) Estimate continuing value at Year 3. |

| |

| 9. (5 points) Estimate the total value of the firm. |

| |

| 10. (5 points) Estimate the intrinsic value per share of the stock. |

| |

force Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? A58 x fx 19 Operating working capital 20 Property and equipment 21 Lovested capital 64.6 258 40 69.5 278.00 347,5 786 314.40 393 0 87.1 340 40 4355 Share outstanding millions 23 Debt 1020 102.0 221.0 24 Shareholders' equity 1020 2455 1020 291.0 Equity value. S million WACC Contribution 26 Other Available data available for the company 27 Operating profit tax rate 26 Shares outstanding, millions 29 Current share prices 38.00 30 Pretax cost of debt 31 Cost of equity 32 The growth rate after Year 3 33 Non operating assets 12 unit: s million Total Capita Pof explicit PV of continuing value py of operations Midyear adjustment PV of nonoperating assets Total value of the form Debt Equity value Compare this with the stock price Value per share (Unit:$) Questions 5-10 + Ready

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts