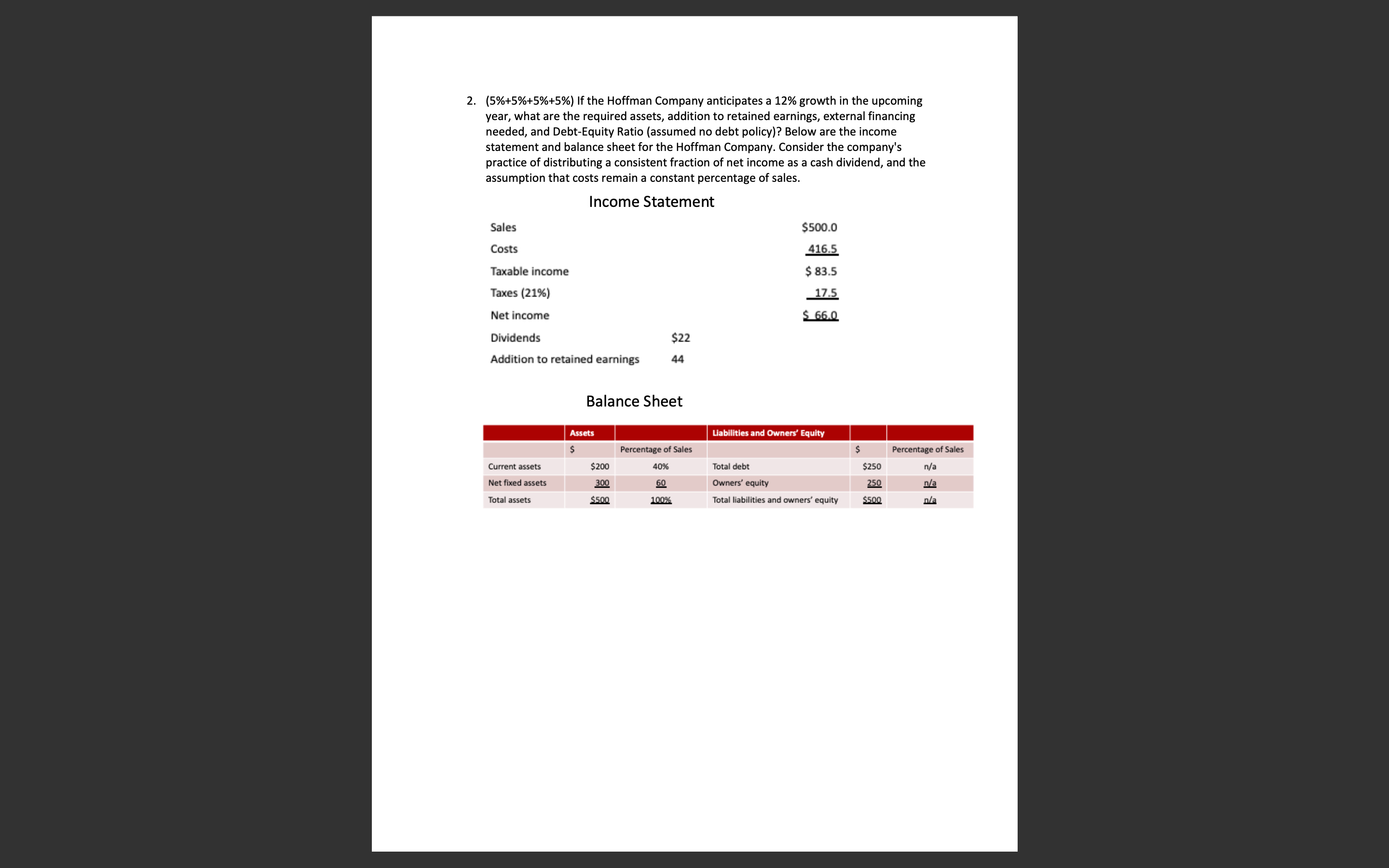

Question: ( 5 % + 5 % + 5 % + 5 % ) If the Hoffman Company anticipates a 1 2 % growth in the

If the Hoffman Company anticipates a growth in the upcoming

year, what are the required assets, addition to retained earnings, external financing

needed, and DebtEquity Ratio assumed no debt policy Below are the income

statement and balance sheet for the Hoffman Company. Consider the company's

practice of distributing a consistent fraction of net income as a cash dividend, and the

assumption that costs remain a constant percentage of sales.

Income Statement

Sales

Costs

Taxable income

Taxes

Net income

Dividends

Addition to retained earnings

$

$

$

$

Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock