Question: 5 / 6 / 2 0 2 5 Use the following information to answer questions 1 5 and 1 6 . Havel Roboties Company (

Use the following information to answer questions and

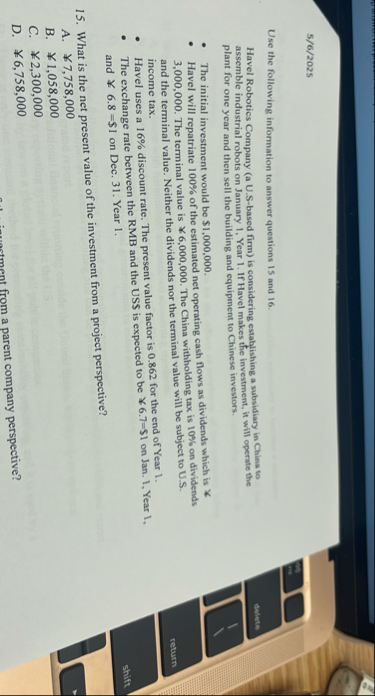

Havel Roboties Company a USbased firm is considering establishing a subsidiary in China to assemble industrial robots on January Year If Havel makes the investment, it will operate the plant for one year and then sell the building and equipment to Chinese investors.

The initial investment would be $

Havel will repatriate of the estimated net operating eash flows as dividends which is The terminal value is $ The China withholding tax is on dividends and the terminal value. Neither the dividends nor the terminal value will be subject to US

Havel uses a discount rate. The present value factor is for the end of Year income tax.

The exchange rate between the RMB and the US$ is expected to be on Jan. Year and $ on Dec. Year

What is the net present value of the investment from a project perspective?

A

B

C

D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock