Question: 5 6 7 8 INFORMATION: Goldfields Limited intends purchasing a new machine to replace an existing machine. The new machine will have a purchase price

5

6

7

8

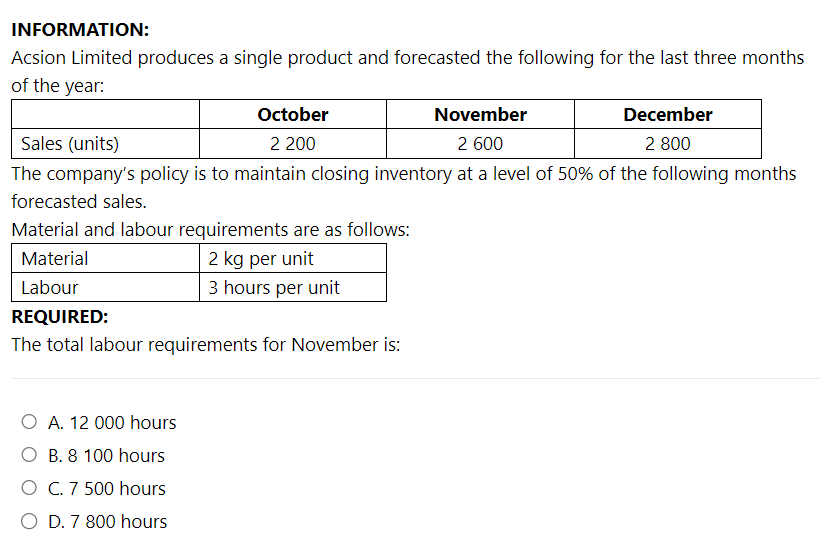

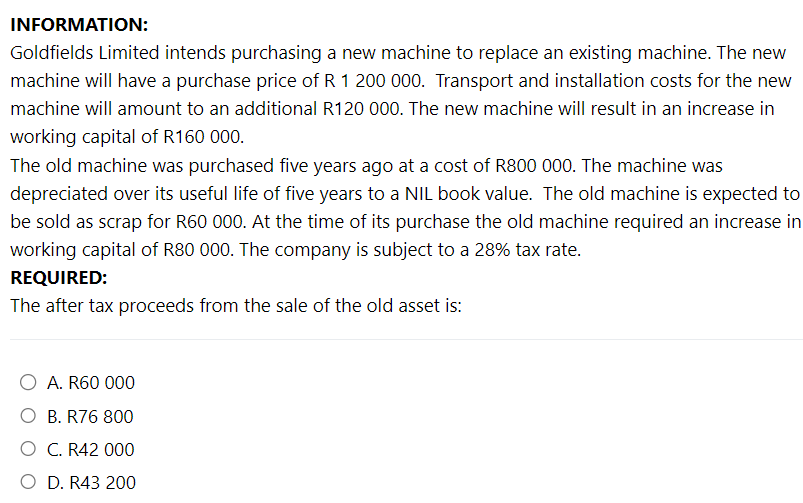

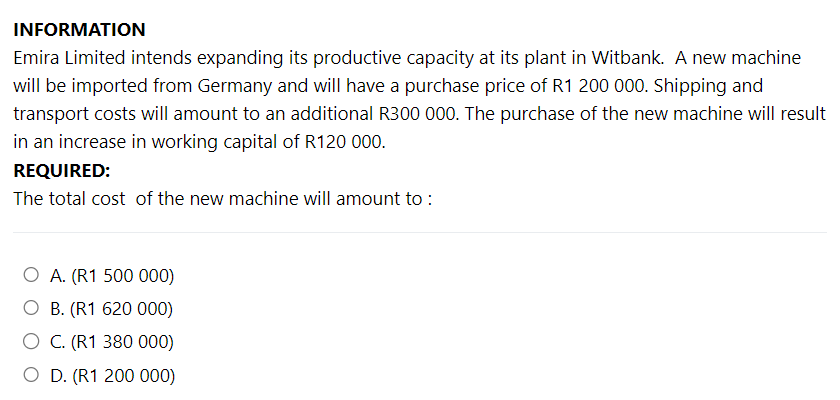

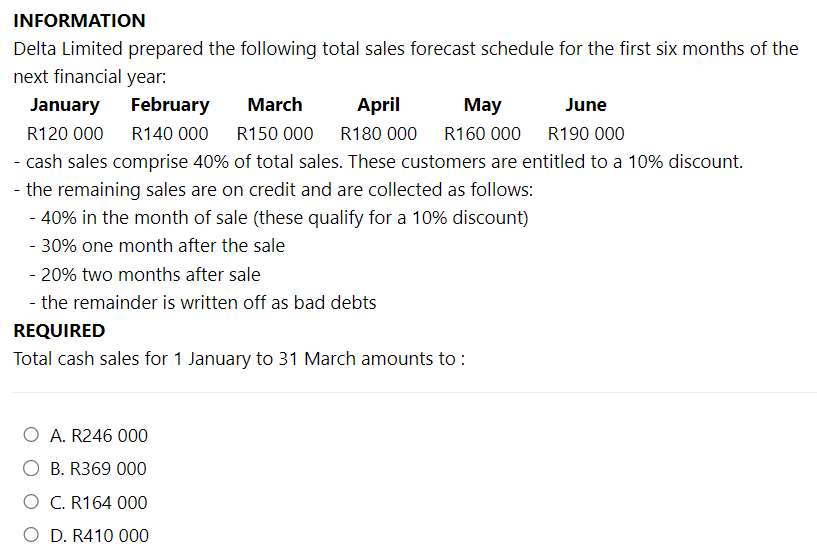

INFORMATION: Goldfields Limited intends purchasing a new machine to replace an existing machine. The new machine will have a purchase price of R 1200 000. Transport and installation costs for the new machine will amount to an additional R120 000. The new machine will result in an increase in working capital of R160 000 . The old machine was purchased five years ago at a cost of R800 000. The machine was depreciated over its useful life of five years to a NIL book value. The old machine is expected to be sold as scrap for R60 000. At the time of its purchase the old machine required an increase in working capital of R80 000 . The company is subject to a 28% tax rate. REQUIRED: The after tax proceeds from the sale of the old asset is: A. R60 000 B. R76 800 C. R42 000 D. R43 200 INFORMATION: Acsion Limited produces a single product and forecasted the following for the last three months of the year: The company's policy is to maintain closing inventory at a level of 50% of the following months forecasted sales. Material and labour requirements are as follows: REQUIRED: The total labour requirements for November is: A. 12000 hours B. 8100 hours C. 7500 hours D. 7800 hours INFORMATION Emira Limited intends expanding its productive capacity at its plant in Witbank. A new machine will be imported from Germany and will have a purchase price of R1 200000 . Shipping and transport costs will amount to an additional R300 000. The purchase of the new machine will result in an increase in working capital of R120 000. REQUIRED: The total cost of the new machine will amount to : A. (R1 500 000) B. (R1 620 000) C. (R1 380 000) D. (R1 200 000) INFORMATION Delta Limited prepared the following total sales forecast schedule for the first six months of the next financial year: - cash sales comprise 40% of total sales. These customers are entitled to a 10% discount. - the remaining sales are on credit and are collected as follows: - 40% in the month of sale (these qualify for a 10% discount) - 30% one month after the sale - 20% two months after sale - the remainder is written off as bad debts REQUIRED Total cash sales for 1 January to 31 March amounts to : A. R246 000 B. R369 000 C. R164 000 D. R410 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts