Question: 5 & 6 go together please help & please explain what your comment s mean what do you mean by n not giving me a

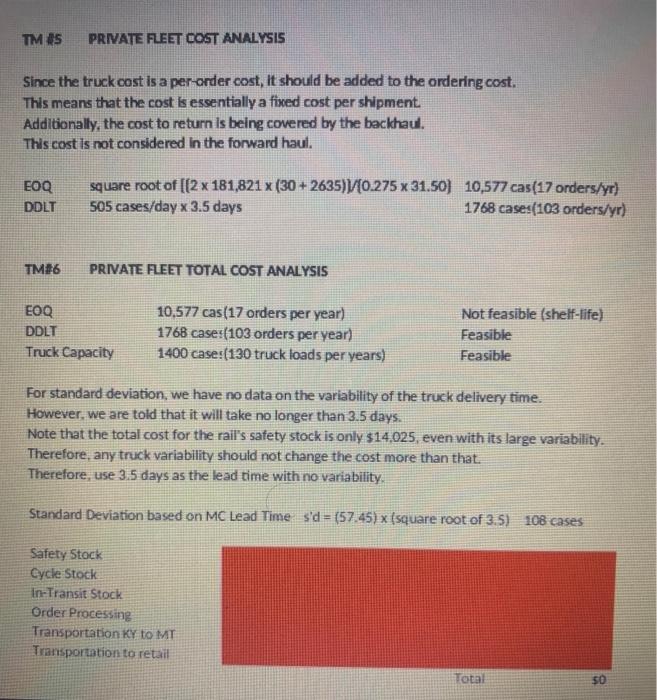

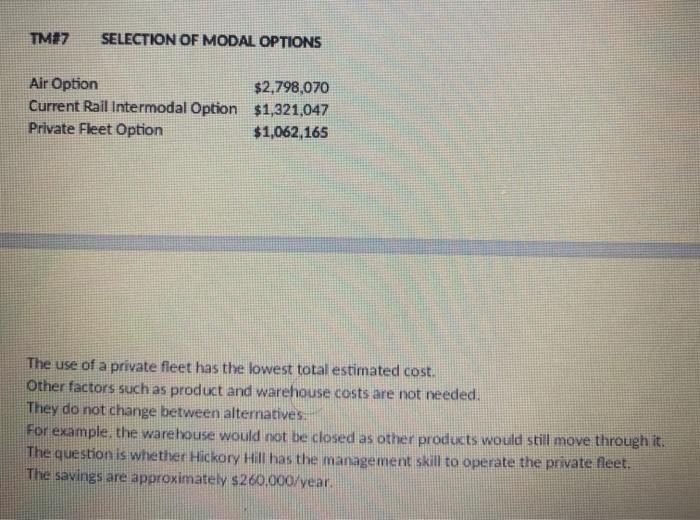

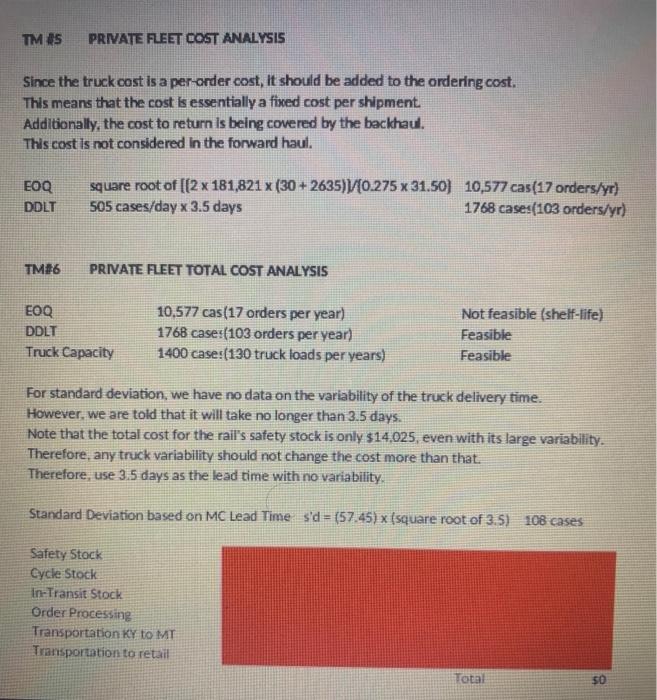

5. Explain the cost of the private fleet at $3,145 per trip. Is it fixed or variable in nature and how does it impact your desired shipment size? 6. What will the total logistical cost be if the company uses the private fleet option? (Include the change in safety stock required/allowed with this option). 7. Which transportation mode alternative plan would you select, and why? TM #S PRIVATE FLEET COST ANALYSIS Since the truck cost is a per-order cost, it should be added to the ordering cost. This means that the cost is essentially a fixed cost per shipment Additionally, the cost to return is being covered by the backhaul. This cost is not considered in the forward haul. EOQ DDLT square root of [[2 x 181,821 x (30 + 2635)]/(0.275 x 31.50) 10,577 cas(17 orders/yr) 505 cases/day x 3.5 days 1768 cases(103 orders/yr) TM#6 PRIVATE FLEET TOTAL COST ANALYSIS EOQ DDLT Truck Capacity 10,577 cas (17 orders per year) 1768 case:(103 orders per year) 1400 case:(130 truck loads per years) Not feasible (shelf-life) Feasible Feasible For standard deviation, we have no data on the variability of the truck delivery time. However, we are told that it will take no longer than 3.5 days. Note that the total cost for the rail's safety stock is only $14,025, even with its large variability. Therefore, any truck variability should not change the cost more than that. Therefore, use 3.5 days as the lead time with no variability Standard Deviation based on MC Lead Times'd = (57.45) x (square root of 3.5) 108 cases Safety Stock Cycle Stock In-Transit Stock Order Processing Transportation KY to MI Transportation to retail Total 50 TMZ SELECTION OF MODAL OPTIONS Air Option $2,798,070 Current Rail Intermodal Option $1,321,047 Private Fleet Option $1,062,165 The use of a private fleet has the lowest total estimated cost. Other factors such as product and warehouse costs are not needed. They do not change between alternatives For example, the warehouse would not be closed as other products would still move through it. The question is whether Hickory Hill has the management skill to operate the private fleet. The savings are approximately $260.000/year. 5. Explain the cost of the private fleet at $3,145 per trip. Is it fixed or variable in nature and how does it impact your desired shipment size? 6. What will the total logistical cost be if the company uses the private fleet option? (Include the change in safety stock required/allowed with this option). TM #S PRIVATE FLEET COST ANALYSIS Since the truck cost is a per-order cost, it should be added to the ordering cost. This means that the cost is essentially a fixed cost per shipment Additionally, the cost to return is being covered by the backhaul. This cost is not considered in the forward haul. EOQ DDLT square root of [[2 x 181,821 x (30 + 2635)]/(0.275 x 31.50) 10,577 cas(17 orders/yr) 505 cases/day x 3.5 days 1768 cases(103 orders/yr) TM#6 PRIVATE FLEET TOTAL COST ANALYSIS EOQ DDLT Truck Capacity 10,577 cas (17 orders per year) 1768 case:(103 orders per year) 1400 case:(130 truck loads per years) Not feasible (shelf-life) Feasible Feasible For standard deviation, we have no data on the variability of the truck delivery time. However, we are told that it will take no longer than 3.5 days. Note that the total cost for the rail's safety stock is only $14,025, even with its large variability. Therefore, any truck variability should not change the cost more than that. Therefore, use 3.5 days as the lead time with no variability Standard Deviation based on MC Lead Times'd = (57.45) x (square root of 3.5) 108 cases Safety Stock Cycle Stock In-Transit Stock Order Processing Transportation KY to MI Transportation to retail Total 50 5. Explain the cost of the private fleet at $3,145 per trip. Is it fixed or variable in nature and how does it impact your desired shipment size? 6. What will the total logistical cost be if the company uses the private fleet option? (Include the change in safety stock required/allowed with this option). 7. Which transportation mode alternative plan would you select, and why? TM #S PRIVATE FLEET COST ANALYSIS Since the truck cost is a per-order cost, it should be added to the ordering cost. This means that the cost is essentially a fixed cost per shipment Additionally, the cost to return is being covered by the backhaul. This cost is not considered in the forward haul. EOQ DDLT square root of [[2 x 181,821 x (30 + 2635)]/(0.275 x 31.50) 10,577 cas(17 orders/yr) 505 cases/day x 3.5 days 1768 cases(103 orders/yr) TM#6 PRIVATE FLEET TOTAL COST ANALYSIS EOQ DDLT Truck Capacity 10,577 cas (17 orders per year) 1768 case:(103 orders per year) 1400 case:(130 truck loads per years) Not feasible (shelf-life) Feasible Feasible For standard deviation, we have no data on the variability of the truck delivery time. However, we are told that it will take no longer than 3.5 days. Note that the total cost for the rail's safety stock is only $14,025, even with its large variability. Therefore, any truck variability should not change the cost more than that. Therefore, use 3.5 days as the lead time with no variability Standard Deviation based on MC Lead Times'd = (57.45) x (square root of 3.5) 108 cases Safety Stock Cycle Stock In-Transit Stock Order Processing Transportation KY to MI Transportation to retail Total 50 TMZ SELECTION OF MODAL OPTIONS Air Option $2,798,070 Current Rail Intermodal Option $1,321,047 Private Fleet Option $1,062,165 The use of a private fleet has the lowest total estimated cost. Other factors such as product and warehouse costs are not needed. They do not change between alternatives For example, the warehouse would not be closed as other products would still move through it. The question is whether Hickory Hill has the management skill to operate the private fleet. The savings are approximately $260.000/year. 5. Explain the cost of the private fleet at $3,145 per trip. Is it fixed or variable in nature and how does it impact your desired shipment size? 6. What will the total logistical cost be if the company uses the private fleet option? (Include the change in safety stock required/allowed with this option). TM #S PRIVATE FLEET COST ANALYSIS Since the truck cost is a per-order cost, it should be added to the ordering cost. This means that the cost is essentially a fixed cost per shipment Additionally, the cost to return is being covered by the backhaul. This cost is not considered in the forward haul. EOQ DDLT square root of [[2 x 181,821 x (30 + 2635)]/(0.275 x 31.50) 10,577 cas(17 orders/yr) 505 cases/day x 3.5 days 1768 cases(103 orders/yr) TM#6 PRIVATE FLEET TOTAL COST ANALYSIS EOQ DDLT Truck Capacity 10,577 cas (17 orders per year) 1768 case:(103 orders per year) 1400 case:(130 truck loads per years) Not feasible (shelf-life) Feasible Feasible For standard deviation, we have no data on the variability of the truck delivery time. However, we are told that it will take no longer than 3.5 days. Note that the total cost for the rail's safety stock is only $14,025, even with its large variability. Therefore, any truck variability should not change the cost more than that. Therefore, use 3.5 days as the lead time with no variability Standard Deviation based on MC Lead Times'd = (57.45) x (square root of 3.5) 108 cases Safety Stock Cycle Stock In-Transit Stock Order Processing Transportation KY to MI Transportation to retail Total 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts