Question: 5. (6 points) ALO is considering when to replace an existing machine. The new replacement machine will cost $25000 now and will require maintenance of

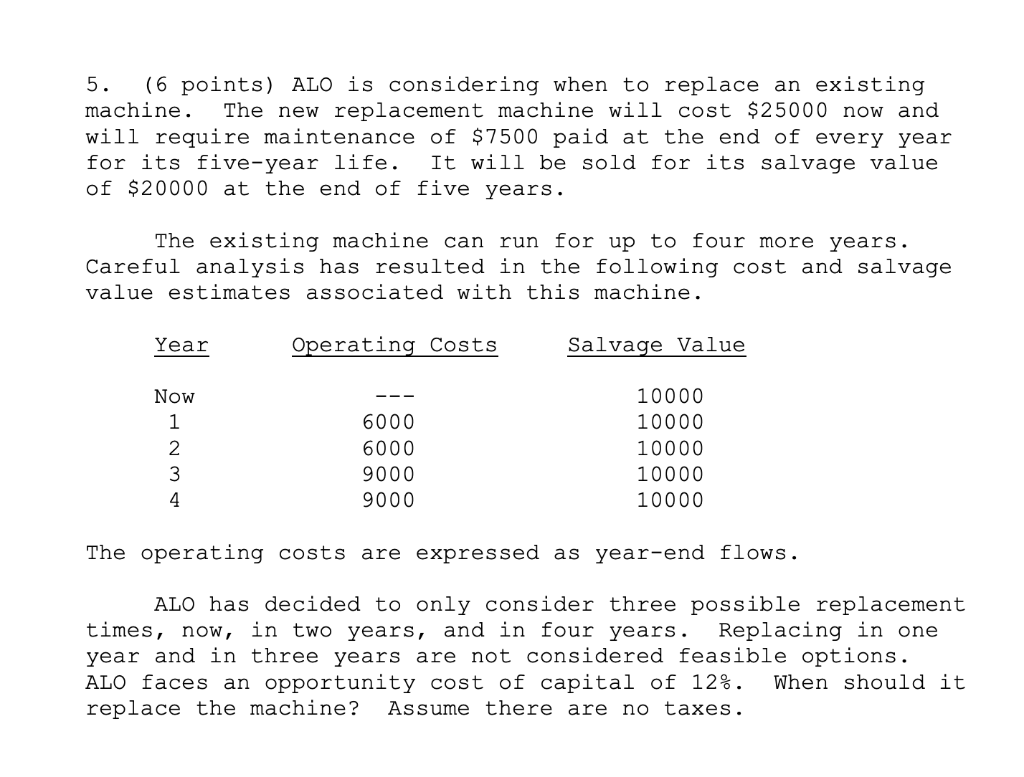

5. (6 points) ALO is considering when to replace an existing machine. The new replacement machine will cost $25000 now and will require maintenance of $7500 paid at the end of every year for its five-year life. It will be sold for its salvage value of $20000 at the end of five years. The existing machine can run for up to four more years. Careful analysis has resulted in the following cost and salvage value estimates associated with this machine. Year Operating costs Salvage Value Now 1 2 3 4 6000 6000 9000 9000 10000 10000 10000 10000 10000 The operating costs are expressed as year-end flows. ALO has decided to only consider three possible replacement times, now, in two years, and in four years. Replacing in one year and in three years are not considered feasible options. ALO faces an opportunity cost of capital of 12%. When should it replace the machine? Assume there are no taxes. 5. (6 points) ALO is considering when to replace an existing machine. The new replacement machine will cost $25000 now and will require maintenance of $7500 paid at the end of every year for its five-year life. It will be sold for its salvage value of $20000 at the end of five years. The existing machine can run for up to four more years. Careful analysis has resulted in the following cost and salvage value estimates associated with this machine. Year Operating costs Salvage Value Now 1 2 3 4 6000 6000 9000 9000 10000 10000 10000 10000 10000 The operating costs are expressed as year-end flows. ALO has decided to only consider three possible replacement times, now, in two years, and in four years. Replacing in one year and in three years are not considered feasible options. ALO faces an opportunity cost of capital of 12%. When should it replace the machine? Assume there are no taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts