Question: 5 - 8 please. dont use excel! Project B: Buying a car Project A: Buying a personal computer 2. This is an example of :(assume

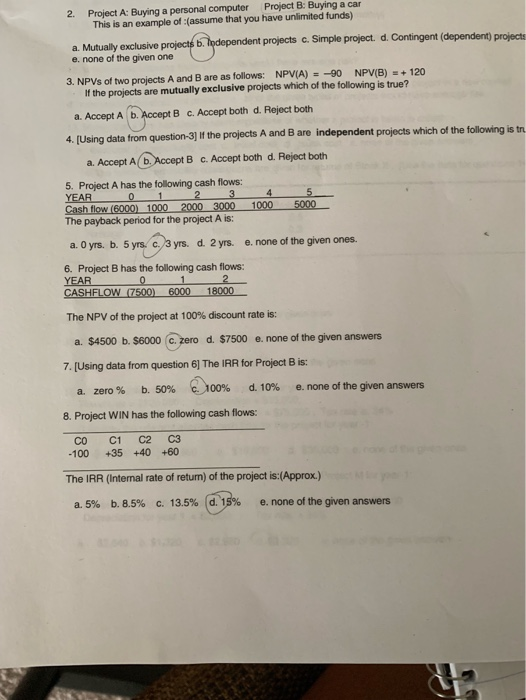

Project B: Buying a car Project A: Buying a personal computer 2. This is an example of :(assume that you have unlimited funds) a. Mutually exclusive projects b. Ipdependent projects c. Simple project. d. Contingent (dependent) projects e. none of the given one 3. NPVS of two projects A and B are as follows: NPV(A) =-90 If the projects are mutually exclusive projects which of the following is true? NPV(B)+ 120 a. Accept A b. Accept B c. Accept both d. Reject both 4. [Using data from question-3] if the projects A and B are independent projects which of the following is tr a. Accept A(b. Accept B c. Accept both d. Reject both 5. Project A has the following cash flows: YEAR Cash flow (6000) 1000 The payback period for the project A is: 5 5000 4 3 2 0 1000 2000 3000 e. none of the given ones. a. 0 yrs. b. 5 yrs. c./3 yrs. d. 2 yrs. 6. Project B has the following cash flows: YEAR CASHFLOW (7500) 2 18000 1 6000 The NPV of the project at 100 % discount rate is: zero d. $7500 e. none of the given answers a. $4500 b. $6000 c. 2 7. [Using data from question 6] The IRR for Project B is: e. none of the given answers c. 100% d. 10% b. 50% zero % a. 8. Project WIN has the following cash flows: C2 C3 C1 CO +35 +40 +60 -100 The IRR (Internal rate of retun) of the project is:(Approx.) e. none of the given answers a. 5% b. 8.5% c. 13.5 % d. 15 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts