Question: 5. A company signed a $10,000 note payable with an interest rate of 5% on October 1, 2019. Assuming no payments have been made,

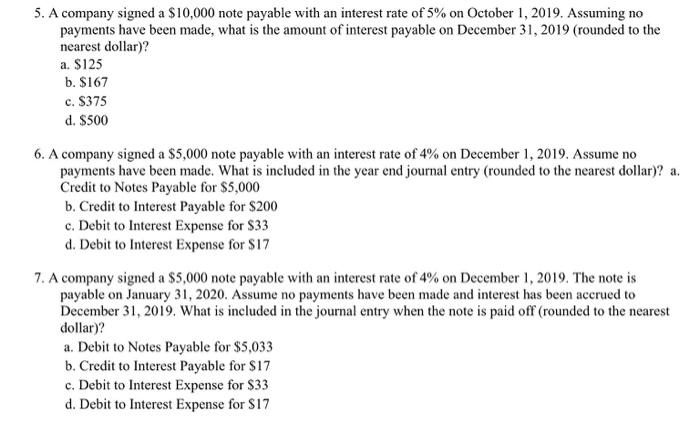

5. A company signed a $10,000 note payable with an interest rate of 5% on October 1, 2019. Assuming no payments have been made, what is the amount of interest payable on December 31, 2019 (rounded to the nearest dollar)? a. $125 b. $167 c. $375 d. $500 6. A company signed a $5,000 note payable with an interest rate of 4% on December 1, 2019. Assume no payments have been made. What is included in the year end journal entry (rounded to the nearest dollar)? a. Credit to Notes Payable for $5,000 b. Credit to Interest Payable for $200 c. Debit to Interest Expense for $33 d. Debit to Interest Expense for $17 7. A company signed a $5,000 note payable with an interest rate of 4% on December 1, 2019. The note is payable on January 31, 2020. Assume no payments have been made and interest has been accrued to December 31, 2019. What is included in the journal entry when the note is paid off (rounded to the nearest dollar)? a. Debit to Notes Payable for $5,033 b. Credit to Interest Payable for $17 c. Debit to Interest Expense for $33 d. Debit to Interest Expense for $17

Step by Step Solution

There are 3 Steps involved in it

For question 5 The interest for 3 months on a 10000 note at 5 is 10000005312 12... View full answer

Get step-by-step solutions from verified subject matter experts