Question: 5. a. Explain how a hedge fund manager might appear to be able to beat the market for several years, and yet have no privileged

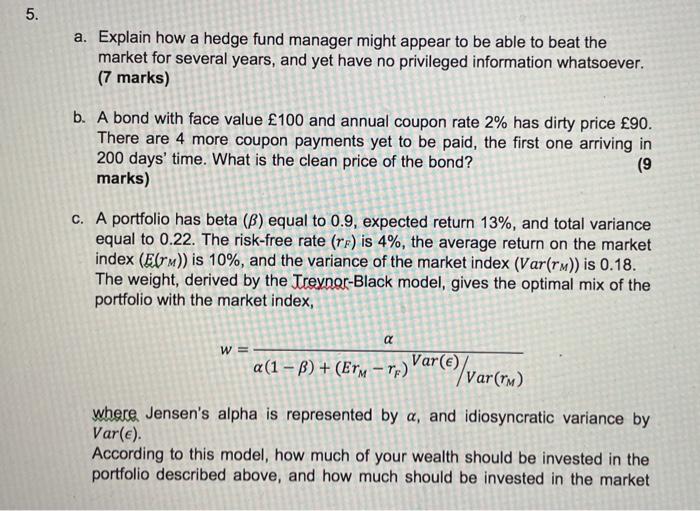

5. a. Explain how a hedge fund manager might appear to be able to beat the market for several years, and yet have no privileged information whatsoever. (7 marks) b. A bond with face value 100 and annual coupon rate 2% has dirty price 90. There are 4 more coupon payments yet to be paid, the first one arriving in 200 days' time. What is the clean price of the bond? (9 marks) C. A portfolio has beta () equal to 0.9, expected return 13%, and total variance equal to 0.22. The risk-free rate (rp) is 4%, the average return on the market index (Erm)) is 10%, and the variance of the market index (Var(rm)) is 0.18. The weight, derived by the Treyner-Black model, gives the optimal mix of the portfolio with the market index, a w= a(1 B) + (Erm r;) Var@/var(rw) where Jensen's alpha is represented by a, and idiosyncratic variance by Var(e) According to this model, how much of your wealth should be invested in the portfolio described above, and how much should be invested in the market 5. a. Explain how a hedge fund manager might appear to be able to beat the market for several years, and yet have no privileged information whatsoever. (7 marks) b. A bond with face value 100 and annual coupon rate 2% has dirty price 90. There are 4 more coupon payments yet to be paid, the first one arriving in 200 days' time. What is the clean price of the bond? (9 marks) C. A portfolio has beta () equal to 0.9, expected return 13%, and total variance equal to 0.22. The risk-free rate (rp) is 4%, the average return on the market index (Erm)) is 10%, and the variance of the market index (Var(rm)) is 0.18. The weight, derived by the Treyner-Black model, gives the optimal mix of the portfolio with the market index, a w= a(1 B) + (Erm r;) Var@/var(rw) where Jensen's alpha is represented by a, and idiosyncratic variance by Var(e) According to this model, how much of your wealth should be invested in the portfolio described above, and how much should be invested in the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts