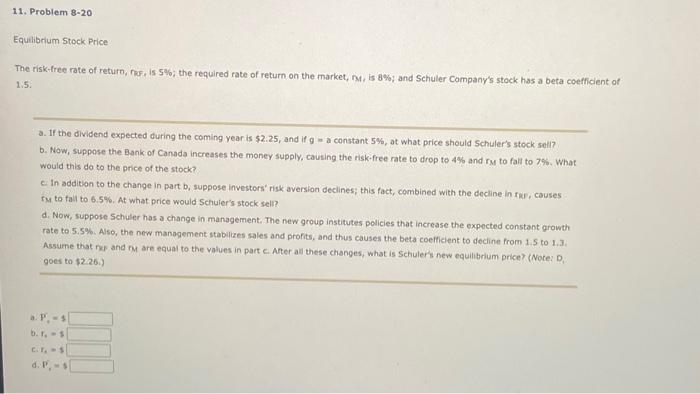

Question: 5. a. If the dividend expected during the coming year is $2.25, and if 9 = a constant 5%, at what price should Schuler's stock

5. a. If the dividend expected during the coming year is $2.25, and if 9 = a constant 5%, at what price should Schuler's stock seli? b. Now, suppose the Bank of Canada increases the money supply, causing the risk-free rate to drop to 4% and rM to fall to 7%. What would this do to the price of the stock? C In addition to the change in part b, suppose investors' risk aversion declines; this fact, combined with the decline in fik, causes rM to fall to 6.5%. At what price would Schuler's stock seil? d. Now, suppose Schuler has a change in management. The new group institutes policies that increase the expected constant growth rate to 5.5%. Also, the new management stabilizes sales and profits, and thus causes the beta coefficient to decline from 1.5 to 1.3 . Assume that n=5 and m are equal to the values in part C. After all these changes, what is Schuler's new equilibrium price? (Note: D, goes to \$226.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts