Question: Please be specific, answer all parts step by step, and show the formula you use. Thank you! 1. (a) The risk-free rate of return is

Please be specific, answer all parts step by step, and show the formula you use. Thank you!

Please be specific, answer all parts step by step, and show the formula you use. Thank you!

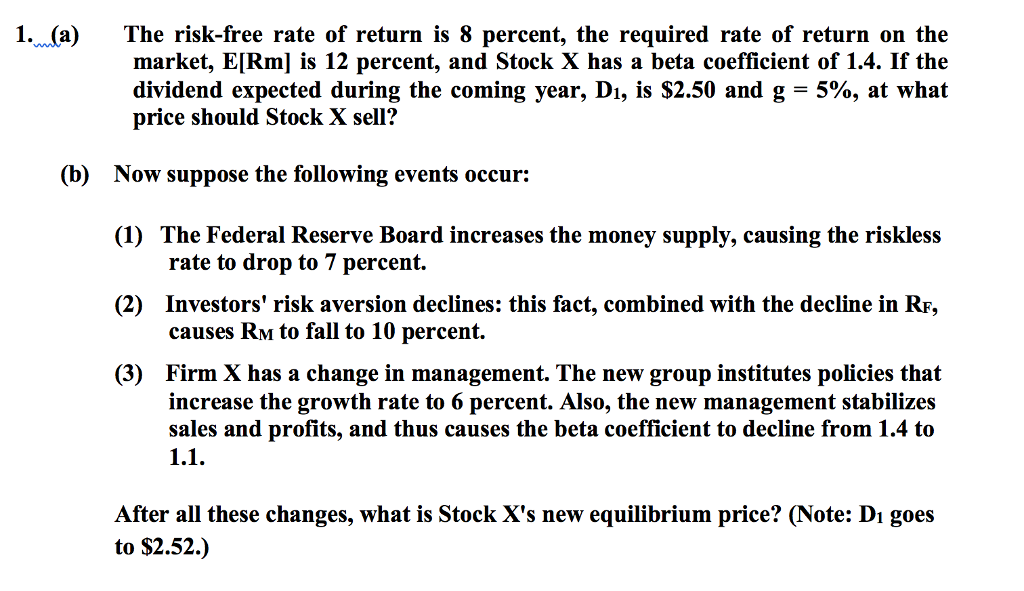

1. (a) The risk-free rate of return is 8 percent, the required rate of return on the market, E[Rm] is 12 percent, and Stock X has a beta coefficient of 1.4. If the dividend expected during the coming year, D, is $2.50 and g = 5%, at what price should Stock X sell? Now suppose the following events occur: (1) (2) (3) (b) The Federal Reserve Board increases the money supply, causing the riskless rate to drop to 7 percent. Investors' risk aversion declines: this fact, combined with the decline in RF, causes RM to fall to 10 percent. Firm X has a change in management. The new group institutes policies that increase the growth rate to 6 percent. Also, the new management stabilizes sales and profits, and thus causes the beta coefficient to decline from 1.4 to After all these changes, what is Stock X's new equilibrium price? (Note: Di goes to $2.52.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts