Question: 5. (a) Suppose that the current term structure is flat and all spot rates are equal to 10% per annum. A bond portfolio manager is

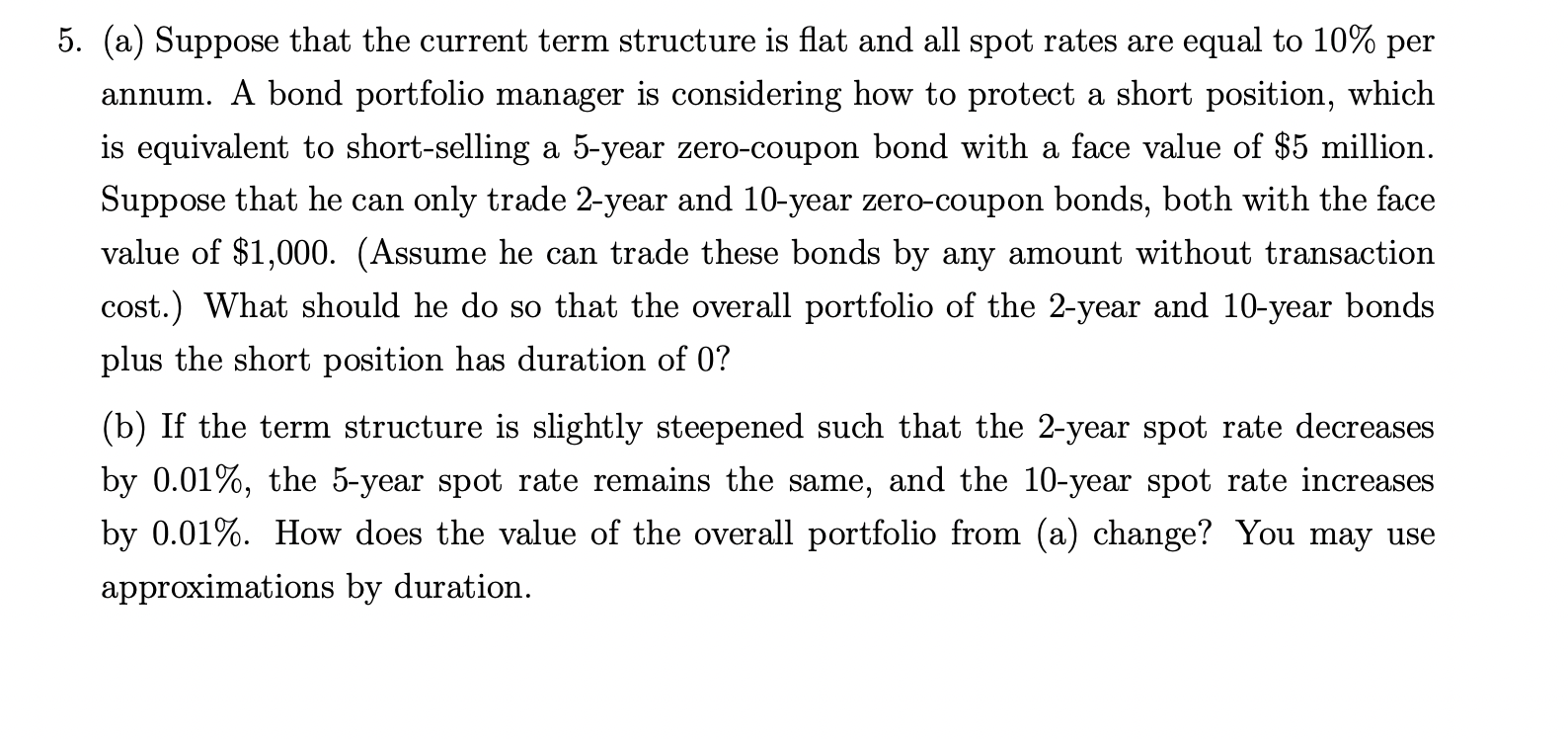

5. (a) Suppose that the current term structure is flat and all spot rates are equal to 10% per annum. A bond portfolio manager is considering how to protect a short position, which is equivalent to short-selling a 5-year zero-coupon bond with a face value of $5 million. Suppose that he can only trade 2-year and 10-year zero-coupon bonds, both with the face value of $1,000. (Assume he can trade these bonds by any amount without transaction cost.) What should he do so that the overall portfolio of the 2-year and 10-year bonds plus the short position has duration of 0 ? (b) If the term structure is slightly steepened such that the 2-year spot rate decreases by 0.01%, the 5 -year spot rate remains the same, and the 10-year spot rate increases by 0.01%. How does the value of the overall portfolio from (a) change? You may use approximations by duration. 5. (a) Suppose that the current term structure is flat and all spot rates are equal to 10% per annum. A bond portfolio manager is considering how to protect a short position, which is equivalent to short-selling a 5-year zero-coupon bond with a face value of $5 million. Suppose that he can only trade 2-year and 10-year zero-coupon bonds, both with the face value of $1,000. (Assume he can trade these bonds by any amount without transaction cost.) What should he do so that the overall portfolio of the 2-year and 10-year bonds plus the short position has duration of 0 ? (b) If the term structure is slightly steepened such that the 2-year spot rate decreases by 0.01%, the 5 -year spot rate remains the same, and the 10-year spot rate increases by 0.01%. How does the value of the overall portfolio from (a) change? You may use approximations by duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts