Question: 5. (a) Suppose that the current term structure is flat and all spot rates are equal to 10% per annum. A bond portfolio manager

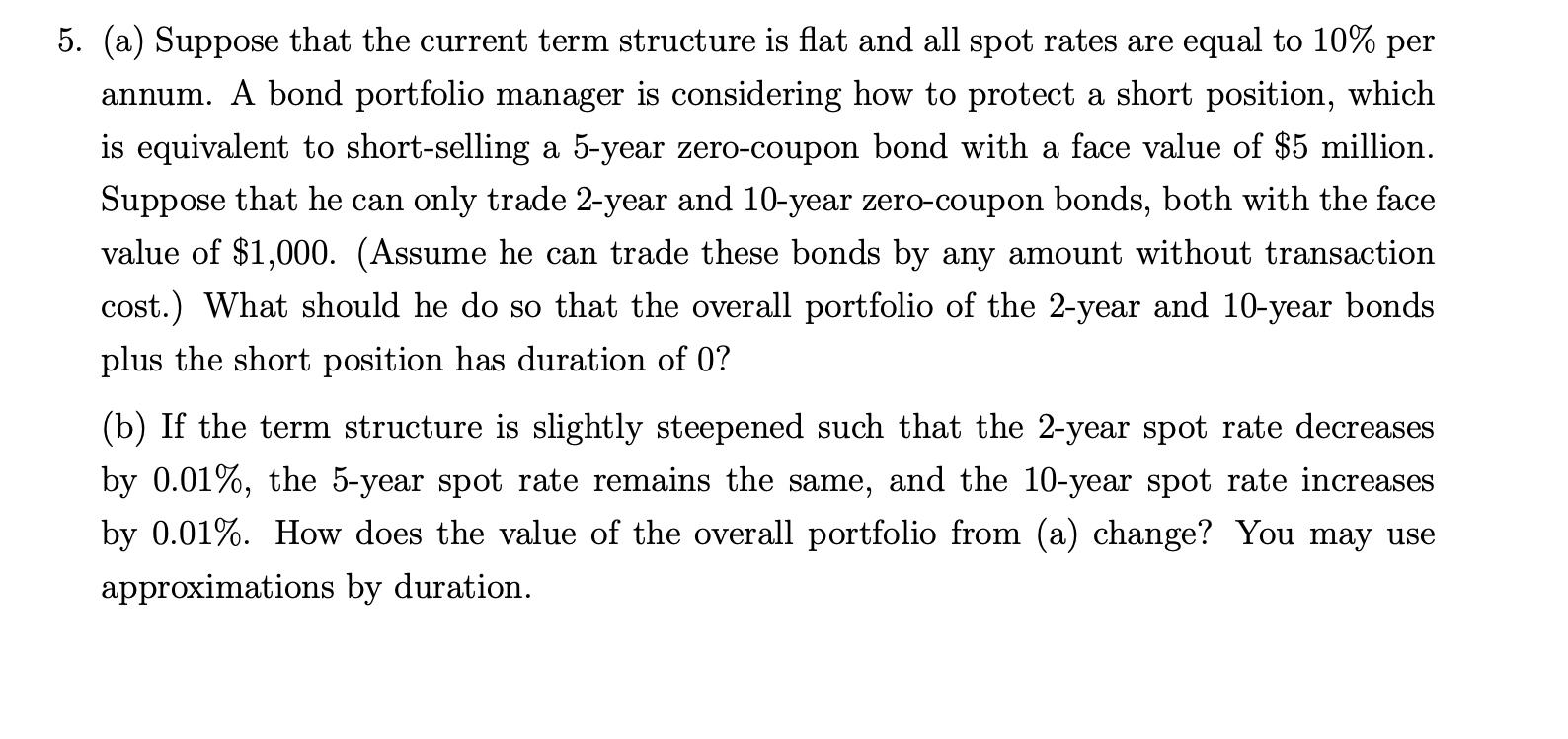

5. (a) Suppose that the current term structure is flat and all spot rates are equal to 10% per annum. A bond portfolio manager is considering how to protect a short position, which is equivalent to short-selling a 5-year zero-coupon bond with a face value of $5 million. Suppose that he can only trade 2-year and 10-year zero-coupon bonds, both with the face value of $1,000. (Assume he can trade these bonds by any amount without transaction cost.) What should he do so that the overall portfolio of the 2-year and 10-year bonds plus the short position has duration of 0? (b) If the term structure is slightly steepened such that the 2-year spot rate decreases by 0.01%, the 5-year spot rate remains the same, and the 10-year spot rate increases by 0.01%. How does the value of the overall portfolio from (a) change? You may use approximations by duration.

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

a To create a portfolio of 2year and 10year zerocoupon bonds that has a duration of 0 we need to fin... View full answer

Get step-by-step solutions from verified subject matter experts