Question: 5. ABC Corp. is considering a project with an initial investment of $1,000,000. A project is supposed to generate an operating cash flow of $150,000

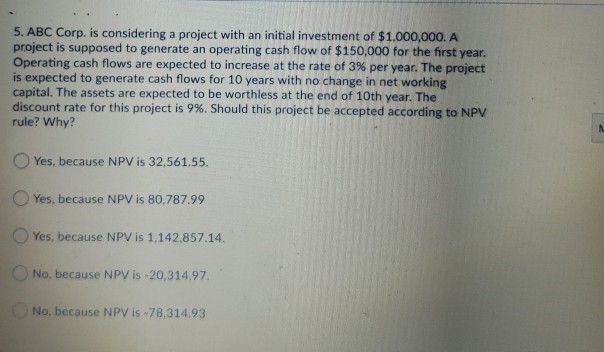

5. ABC Corp. is considering a project with an initial investment of $1,000,000. A project is supposed to generate an operating cash flow of $150,000 for the first year. Operating cash flows are expected to increase at the rate of 3% per year. The project is expected to generate cash flows for 10 years with no change in net working capital. The assets are expected to be worthless at the end of 10th year. The discount rate for this project is 9%. Should this project be accepted according to NPV rule? Why? N Yes, because NPV is 32,561.55. Yes, because NPV is 80,787.99 Yes, because NPV is 1,142,857.14. No, because NPV is -20,314.97 No, because NPV is -78,314.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts