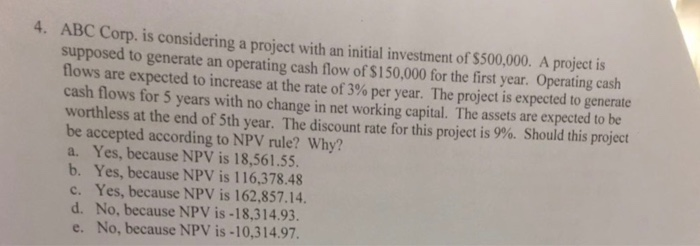

Question: 4. AB C Corp. is considering a project with an initial investment of $500,000. A project is supposed to generate an operating cash flow of

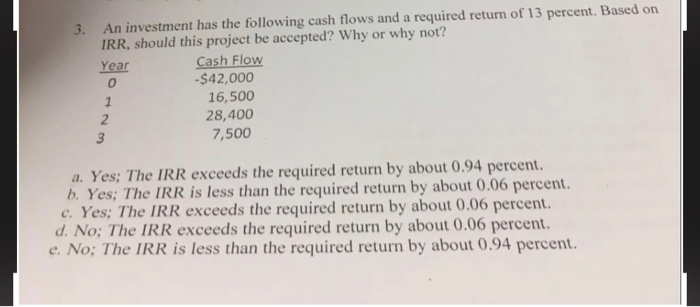

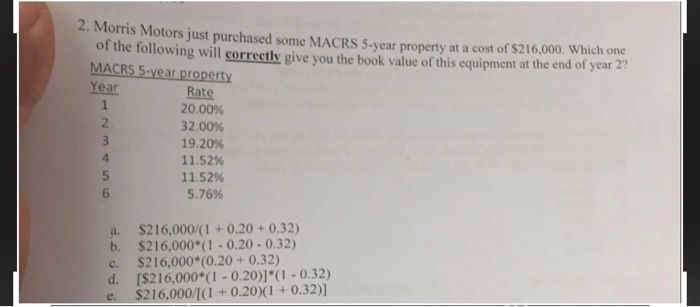

4. AB C Corp. is considering a project with an initial investment of $500,000. A project is supposed to generate an operating cash flow of $150,000 for the first year. Operating cash flows are expected to increase at the rate of 3% per year. The project is expected to generate cash flows for 5 years with no change in net working capital. The assets are expected to be worthless at the end of 5th year. The discount rate for this project is 9%. Should this project be accepted according to NPV rule? Why? a. Yes, because NPV is 18,561.55. b. Yes, because NPV is 116,378.48 c. Yes, because NPV is 162,857.14 d. No, because NPV is-18,314.93 e. No, because NPV is-10,314.97. An investment has the following cash flows and a required return of 13 percent. Based on IRR, should this project be accepted? Why or why not? Year 0 3. Cash Flow -$42,000 16,500 28,400 7,500 a. Yes; The IRR exceeds the required return by about 0.94 percent. b. Yes; The IRR is less than the required return by about 0.06 percent. c, Yes: The IRR exceeds the required return by about 0.06 percent d. No; The IRR exceeds the required return by about 0.06 percent. e. No; The IRR is less than the required return by about 0.94 percent. 2. Morris Motors just purchased some MACRS 5-year property at a cost of $216.000. Which one of the following will correctly give you the book value of this equipment at the end of year 2 MACRS 5-year property Year Rate 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% a. $216,000/(1+0.20+0.32) b. $216,000*(1-0.20-0.32) c. $216,000 (0.20+ 0.32) d. [$216,000*(1 0.20)] (1 0.32) e $216,000/T(1 +0.20(1 +0.32)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts