Question: 5 An ACCA member discovers that a client has deliberately not declared a source of income on their tax return. Which of the following statements

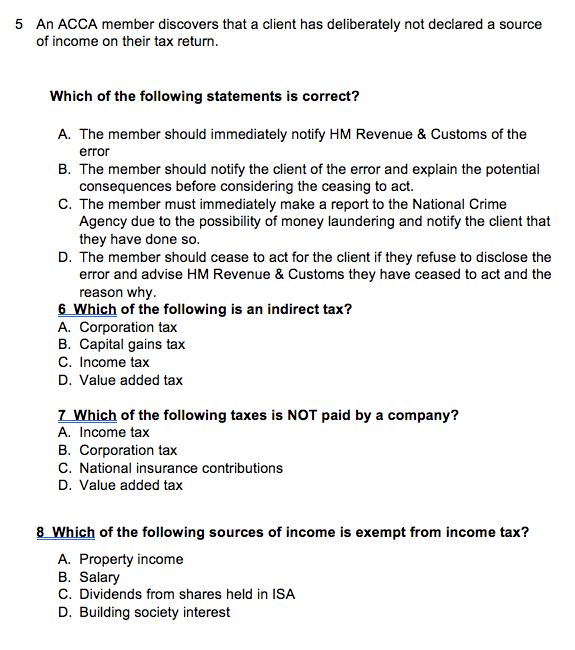

5 An ACCA member discovers that a client has deliberately not declared a source of income on their tax return. Which of the following statements is correct? A. The member should immediately notify HM Revenue & Customs of the error B. The member should notify the client of the error and explain the potential consequences before considering the ceasing to act. C. The member must immediately make a report to the National Crime Agency due to the possibility of money laundering and notify the client that they have done so. D. The member should cease to act for the client if they refuse to disclose the error and advise HM Revenue & Customs they have ceased to act and the reason why. 6 Which of the following is an indirect tax? A. Corporation tax B. Capital gains tax C. Income tax D. Value added tax 7 Which of the following taxes is NOT paid by a company? A. Income tax B. Corporation tax C. National insurance contributions D. Value added tax 8 Which of the following sources of income is exempt from income tax? A. Property income B. Salary C. Dividends from shares held in ISA D. Building society interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts