Question: #5 and 25 only 25. Consider the multifactor model APT with three factors. Portfolio A has a beta of 0.8 on factor 1, a beta

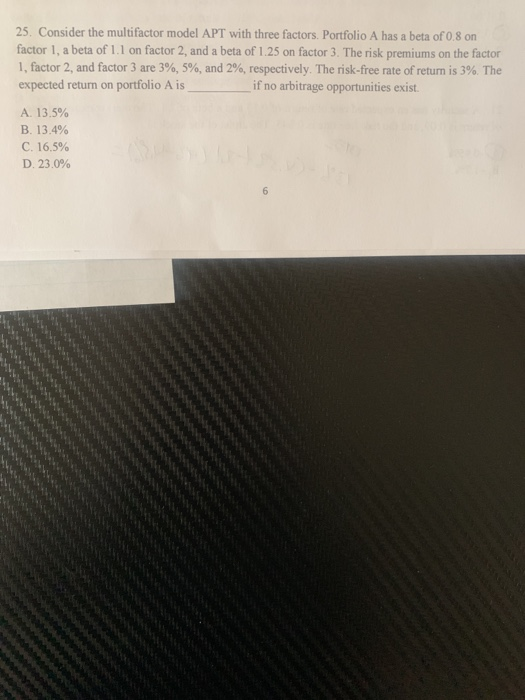

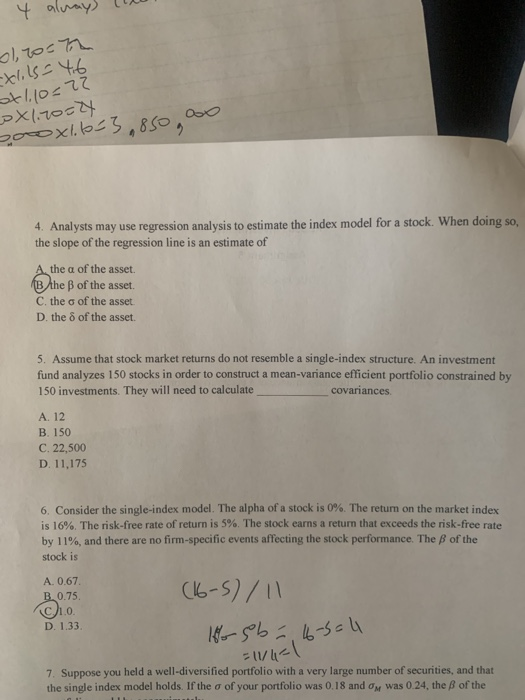

25. Consider the multifactor model APT with three factors. Portfolio A has a beta of 0.8 on factor 1, a beta of 1.1 on factor 2, and a beta of 1.25 on factor 3. The risk premiums on the factor 1, factor 2, and factor 3 are 3%, 5%, and 2%, respectively. The risk-free rate of return is 3%. The expected return on portfolio Ais if no arbitrage opportunities exist. A. 13.5% B. 13.4% C. 16,5% D. 23.0% 4 always to 0170-7 -xlils=46 st1.10=22 PX1.70=24 Sorox1.653 850 ao 4. Analysts may use regression analysis to estimate the index model for a stock. When doing so, the slope of the regression line is an estimate of A. the a of the asset (B lhe of the asset. C. the o of the asset D. the 8 of the asset. 5. Assume that stock market returns do not resemble a single-index structure. An investment fund analyzes 150 stocks in order to construct a mean-vanance efficient portfolio constrained by 150 investments. They will need to calculate covariances A. 12 B. 150 C. 22,500 D. 11,175 6. Consider the single-index model. The alpha of a stock is 0%. The retum on the market index is 16%. The risk-free rate of return is 5%. The stock earns a return that exceeds the risk-free rate by 11%, and there are no firm-specific events affecting the stock performance, stock is A. 0.67 B 0.75 (16-5)/11 1.0. D. 1.33 to sb. 16-5-4 = 11/4=1 7. Suppose you held a well-diversified portfolio with a very large number of securities, and that the single index model holds. If the o of your portfolio was 0.18 and on was 0.24, the B of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts