Question: 5. Answer the questions based on the table below. 1) The firm considers cash dividend using the current cash balance of $80,000,000. What is the

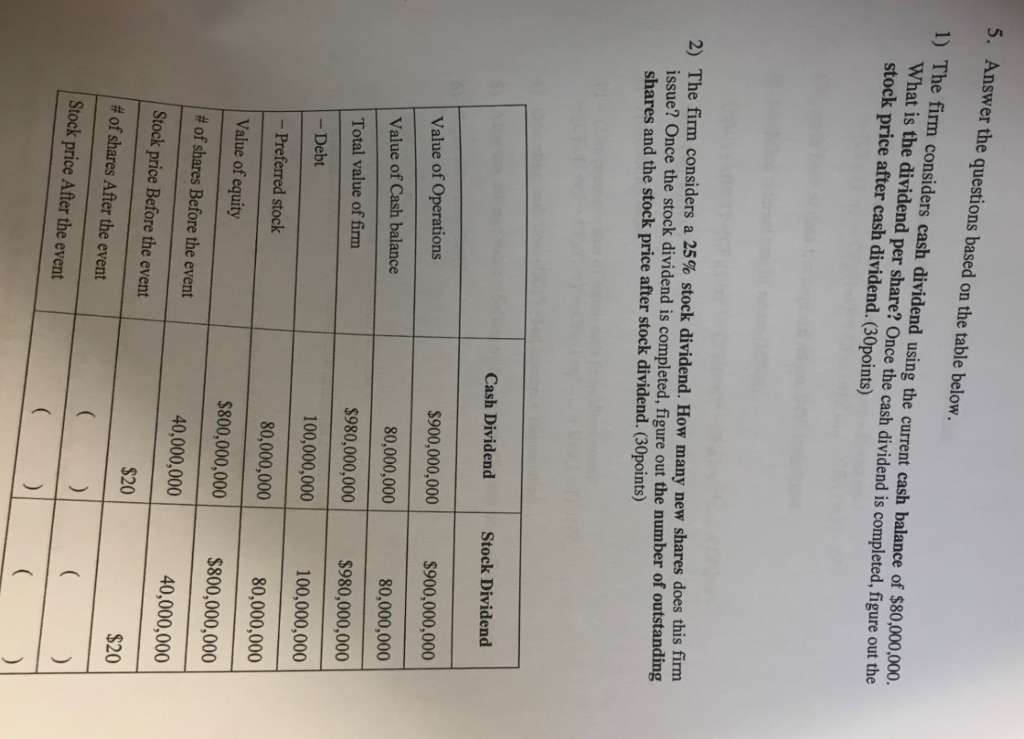

5. Answer the questions based on the table below. 1) The firm considers cash dividend using the current cash balance of $80,000,000. What is the dividend per share? Once the cash dividend is completed, figure out the stock price after cash dividend.(30points) 2) The firm considers a 25% stock dividend. How many new shares does this firm issue? Once the stock dividend is completed, figure out the number of outstanding shares and the stock price after stock dividend. (30points) Cash Dividend Stock Dividend $900,000,000 $900,000,000 80,000,000 $980,000,000 100,000,000 80,000,000 $800,000,000 40,000,000 S20 Value of Operations Value of Cash balance Total value of firm - Debt -Preferred stock Value of equity # of shares Before the event Stock price Before the event # of shares After the event Stock price After the event 80,000,000 $980,000,000 100,000,000 80,000,000 $800,000,000 40,000,000 $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts