Question: part 3 onward 1. Answer the questions based on the table below. Cash Dividend Stock Repurchases Stock Dividend Value of Operations Value of Cash balance

part 3 onward

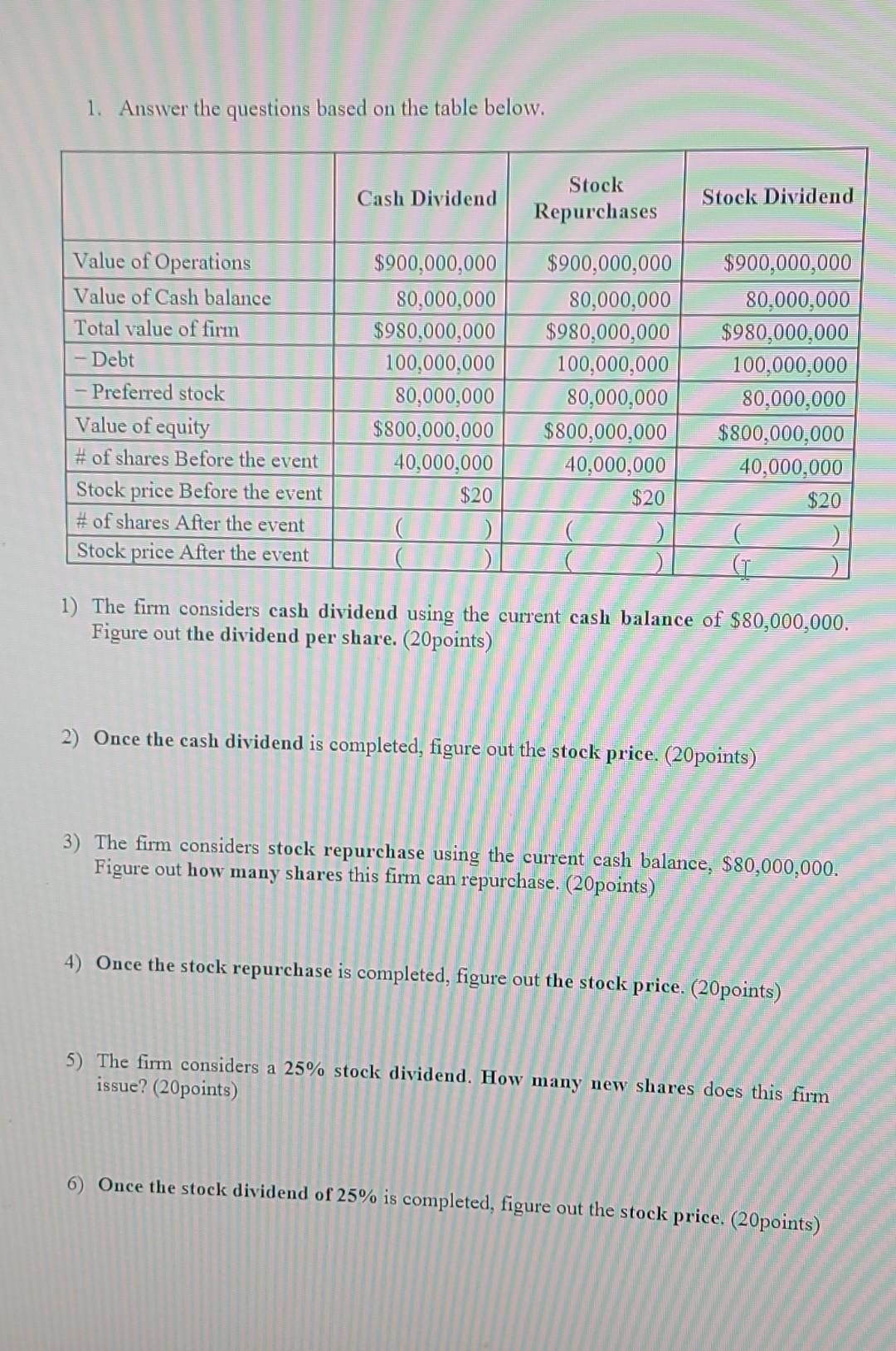

1. Answer the questions based on the table below. Cash Dividend Stock Repurchases Stock Dividend Value of Operations Value of Cash balance Total value of firm - Debt - Preferred stock Value of equity # of shares Before the event Stock price Before the event # of shares After the event Stock price After the event $900,000,000 80,000,000 $980,000,000 100,000,000 80,000,000 $800,000,000 40,000,000 $20 $900,000,000 80,000,000 $980,000,000 100,000,000 80,000,000 $800,000,000 40,000,000 $20 $900,000,000 80,000,000 $980,000,000 100,000,000 80,000,000 $800,000,000 40,000,000 $20 1) The firm considers cash dividend using the current cash balance of $80,000,000. Figure out the dividend per share. (20points) 2) Once the cash dividend is completed, figure out the stock price. (20points) 3) The firm considers stock repurchase using the current cash balance, $80,000,000. Figure out how many shares this firm can repurchase. (20points) 4) Once the stock repurchase is completed, figure out the stock price. (20points) 5) The firm considers a 25% stock dividend. How many new shares does this firm issue? (20points) 6) Once the stock dividend of 25% is completed, figure out the stock price. (20points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts