Question: 5. B) Now consider that RandomCorp decides to issue another bond with similar characteristics as above; but with two major changes. First, it decides to

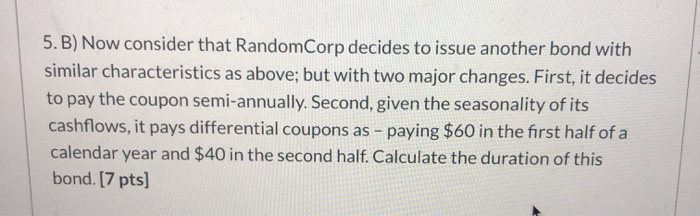

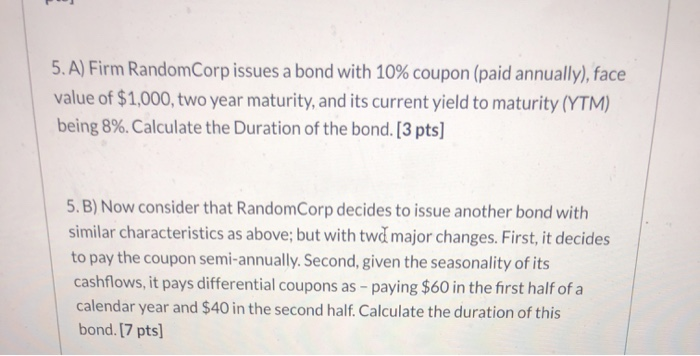

5. B) Now consider that RandomCorp decides to issue another bond with similar characteristics as above; but with two major changes. First, it decides to pay the coupon semi-annually. Second, given the seasonality of its cashflows, it pays differential coupons as - paying $60 in the first half of a calendar year and $40 in the second half. Calculate the duration of this bond. [7 pts] 5. A) Firm RandomCorp issues a bond with 10% coupon (paid annually), face value of $1,000, two year maturity, and its current yield to maturity (YTM) being 8%. Calculate the Duration of the bond. [3 pts] 5.B) Now consider that RandomCorp decides to issue another bond with similar characteristics as above; but with two major changes. First, it decides to pay the coupon semi-annually. Second, given the seasonality of its cashflows, it pays differential coupons as - paying $60 in the first half of a calendar year and $40 in the second half. Calculate the duration of this bond. [7 pts]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts