Question: 5. Binomial Tree (35 points) Consider an upandout call option (a fairly simple exotic option). These call options have two relevant prices: a strike price

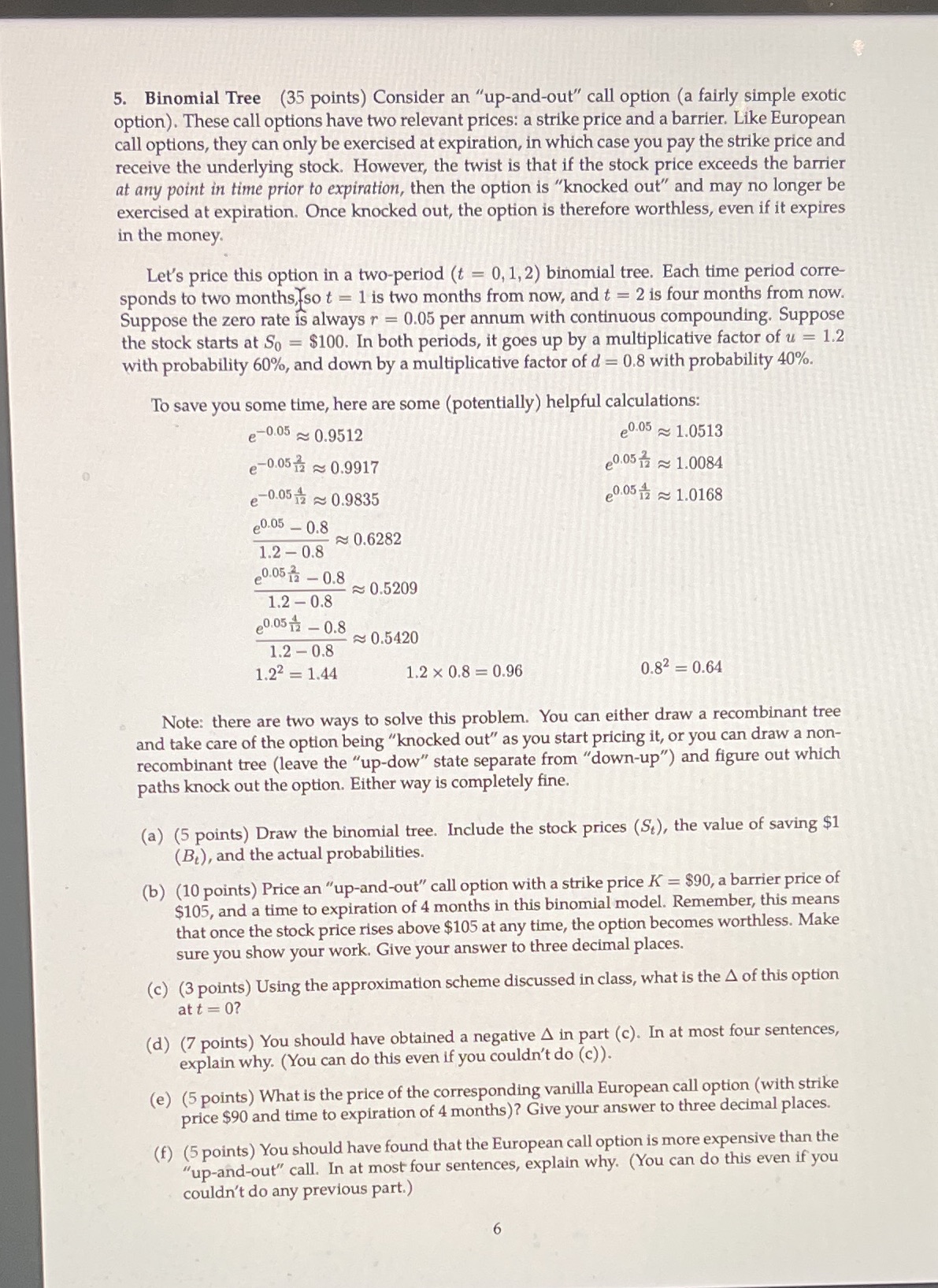

5. Binomial Tree (35 points) Consider an \"upandout\" call option (a fairly simple exotic option). These call options have two relevant prices: a strike price and a barrier. Like European call options, they can only be exercised at expiration, in which case you pay the strike price and receive the underlying stock. However, the twist is that if the stock price exceeds the barrier at any point in time prior to expiration, then the option is "knocked out\" and may no longer be exercised at expiration. Once knocked out, the option is therefore worthless, even if it expires in the money. Let's price this option in a two-period (t = 01 1,2) binomial tree. Each time period corre- sponds to two monthslso t = 1 is two months from now, and t = 2 is four months from now. Suppose the zero rate is always 1- = 0.05 per annum with continuous compounding. Suppose the stock starts at So = $100. In both periods, it goes up by a multiplicative factor of u = 1.2 with probability 60%, and down by a multiplicative factor of d = 0.8 with probability 40%. To save you some time, here are some (potentially) helpful calculations: ' r005 to 0.9512 ell-05 9:: 1.0513 {005% as 0.991? 9005.35 a 1.0034 (\"\"595 a 0.9335 cit-05o? a 1.0168 80.05 _ 0-8 1.2 0.8 80.0513: _ 0.3 1.2 0.8 800514, _ 0.8 1.2 - 0.3 1.22 = 1.44 1.2 x 0.8 = 0.96 0.32 = 0.64 as 0.6282 P: 0.5209 95 0.5420 Note: there are two ways to solve this problem. You can either draw a recombinant tree and take care of the option being \"knocked out" as you start pricing it, or you can draw a non- recombinant tree (leave the \"up-dow" state separate from "down-up\") and gure out which paths knock out the option. Either way is completely fine. (a) (5 points) Draw the binomial tree. Include the stock prices (8,), the value of saving $1 (8;) , and the actual probabilities. (b) (10 points) Price an "upand-out\" call option with a strike price K = $90, a barrier price of $105, and a time to expiration of 4 months in this binomial model. Remember, this means that once the stock price rises above $105 at any time, the option becomes worthless. Make sure you show your work. Give your answer to three decimal places. (c) (3 points) Using the approximation scheme discussed in class, what is the A of this option at t = 0? (d) (7 points) You should have obtained a negative A in part (c). In at most four sentences, explain why. (You can do this even if you couldn't do (c)). (e) (5 points) What is the price of the corresponding vanilla European call option (with strike price $90 and time to expiration of 4 months)? Give your answer to three decimal places. (f) (5 points) You should have found that the European call option is more expensive than the \"up-andout" call. In at most four sentences, explain why. (You can do this even if' you couldn't do any previous part.)