Question: 5. calculate ROE (return on equity): a. 0.5932 b. 0.1289 c. 0.3414 d. 0.4895 6. calculate equity multiplier: a. 3.126 b. 2.277 c. 1.985 7.

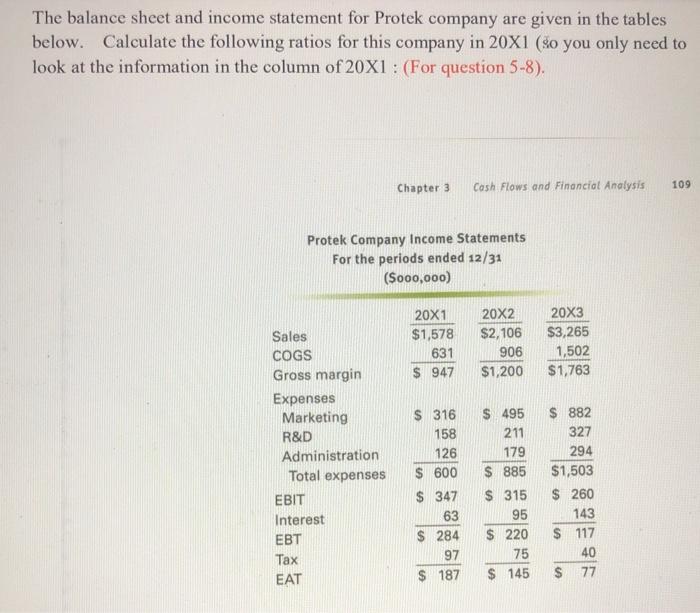

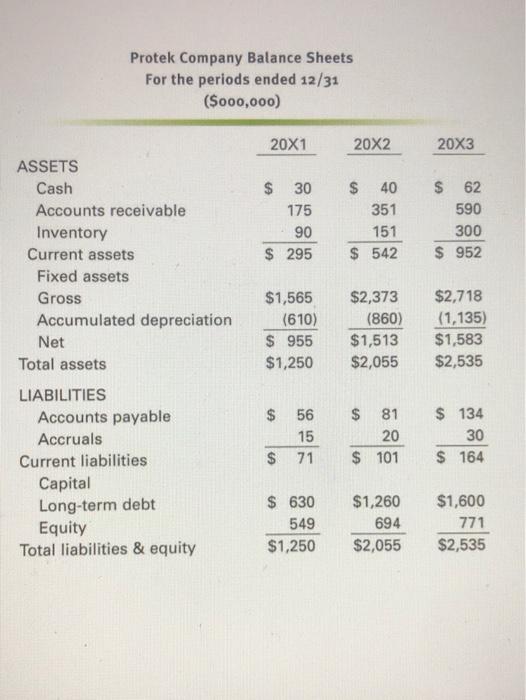

The balance sheet and income statement for Protek company are given in the tables below. Calculate the following ratios for this company in 20X1 (so you only need to look at the information in the column of 20X1: (For question 5-8). Chapter 3 Cash Flows and Financial Analysis 109 Protek Company Income Statements For the periods ended 12/31 (S000,000) 20X1 $1,578 631 $ 947 20X2 $2,106 906 $1,200 20X3 $3,265 1,502 $1,763 Sales COGS Gross margin Expenses Marketing R&D Administration Total expenses EBIT Interest EBT Tax EAT $ 316 158 126 $ 600 $ 347 63 $ 284 97 $ 187 $ 495 211 179 $ 885 $ 315 95 $ 220 75 $ 145 $ 882 327 294 $1,503 $ 260 143 $ 117 40 $ 77 Protek Company Balance Sheets For the periods ended 12/31 (S000,000) 20X1 20X2 20x3 $ 30 175 90 $ 295 $ 40 351 151 $ 542 $ 62 590 300 $ 952 ASSETS Cash Accounts receivable Inventory Current assets Fixed assets Gross Accumulated depreciation Net Total assets LIABILITIES Accounts payable Accruals Current liabilities Capital Long-term debt Equity Total liabilities & equity $1,565 (610) $ 955 $1,250 $2,373 (860) $1,513 $2,055 $2,718 (1,135) $1,583 $2,535 $ 56 15 $ 71 $ 81 20 $ 101 $ 134 30 $ 164 $ 630 549 $1,250 $1,260 694 $2,055 $1,600 771 $2,535

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts