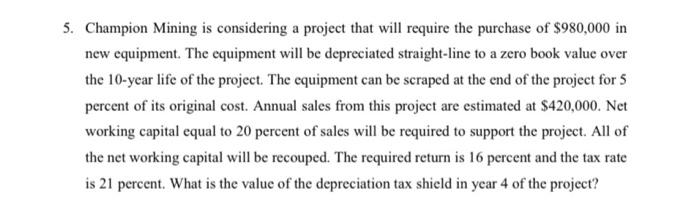

Question: 5. Champion Mining is considering a project that will require the purchase of $980,000 in new equipment. The equipment will be depreciated straight-line to a

5. Champion Mining is considering a project that will require the purchase of $980,000 in new equipment. The equipment will be depreciated straight-line to a zero book value over the 10-year life of the project. The equipment can be scraped at the end of the project for 5 percent of its original cost. Annual sales from this project are estimated at $420,000. Net working capital equal to 20 percent of sales will be required to support the project. All of the net working capital will be recouped. The required return is 16 percent and the tax rate is 21 percent. What is the value of the depreciation tax shield in year 4 of the project? A. $49,000 B. $20,580 C. $34,300 D. $51.500 E. $76,500 6. An 8 percent corporate bond that pays interest semi-annually was issued last year. Which of the following most likely apply to this bond today if the current yield to maturity is 7 percent? 1. a current yield that less than the coupon rate IL a current yield that larger than the coupon rate III. a market price that less than the face value IV. a market price that larger than the face value A. I and III only B. I and IV only C. II and III only D. II and IV only E. none of the above 7. Which of the following statements is correct concerning the term structure of interest rates? 1. Expectations of lower inflation rates in the future tend to lower the slope of the term structure of interest rates. II. The term structure of interest rates includes both an inflation premium and an interest rate risk premium III. The real rate of return has minimal, if any, effect on the slope of the term structure of interest rates. A. I only B. I and II only C. I and III only D. II and III only E. I, II and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts