Question: 5. Checking accounts - The value of overdraft protection programs How Does Overdraft Protection Work, and Why Is It Valuable? An overdraft occurs when an

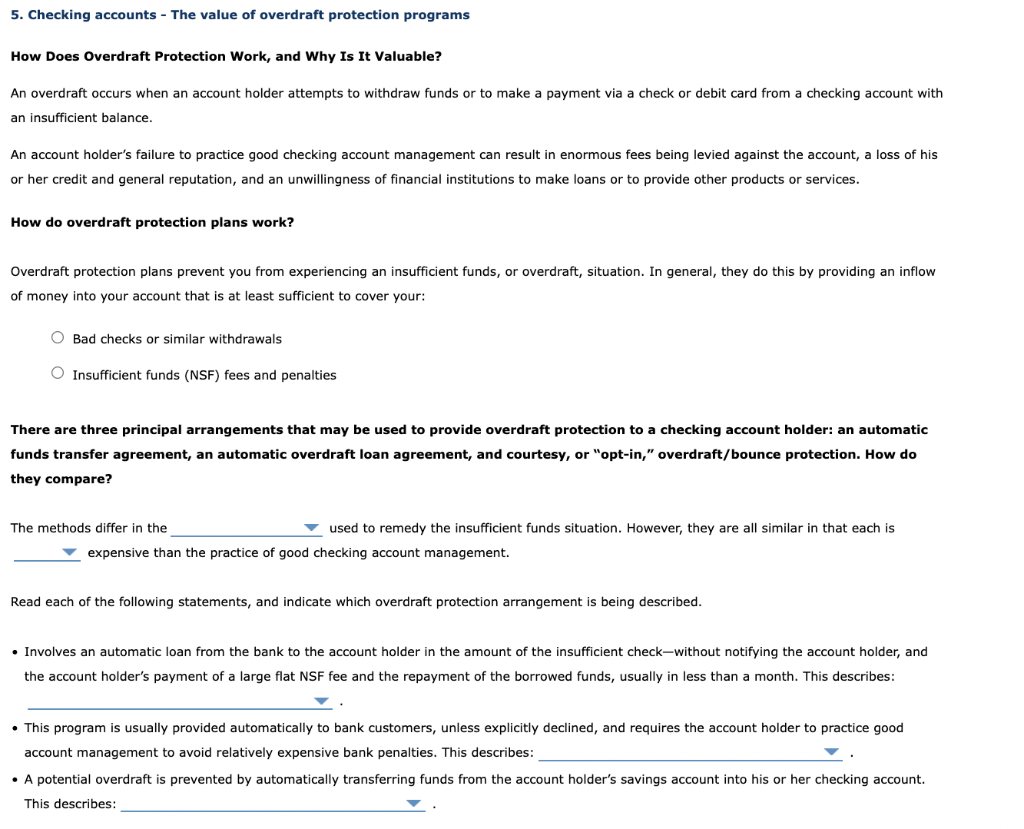

5. Checking accounts - The value of overdraft protection programs How Does Overdraft Protection Work, and Why Is It Valuable? An overdraft occurs when an account holder attempts to withdraw funds or to make a payment via a check or debit card from a checking account with an insufficient balance. loss of his An account holder's failure to practice good checking account management can result in enormous fees being levied against the account, or her credit and general reputation, and an unwillingness of financial institutions to make loans or to provide other products or services. How do overdraft protection plans work? Overdraft protection plans prevent you from experiencing an insufficient funds, or overdraft, situation. In general, they do this by providing an inflow of money into your account that is at least sufficient to cover your: Bad checks or similar withdrawals O Insufficient funds (NSF) fees and penalties There are three principal arrangements that may be used to provide overdraft protection to a checking account holder: an automatic funds transfer agreement, an automatic overdraft loan agreement, and courtesy, or "opt-in," overdraft/bounce protection. How do they compare? The methods differ in the used to remedy the insufficient funds situation. However, they are all similar in that each is expensive than the practice of good checking account management. Read each of the following statements, and indicate which overdraft protection arrangement is being described. Involves an automatic loan from the bank to the account holder in the amount of the insufficient check-without notifying the account holder, and the account holder's payment of a large flat NSF fee and the repayment of the borrowed funds, usually in less than a month. This describes: This program is usually provided automatically to bank customers, unless explicitly declined, and requires the account holder to practice good account management to avoid relatively expensive bank penalties. This describes: A potential overdraft is prevented by automatically transferring funds from the account holder's savings account into his or her checking account. This describes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts