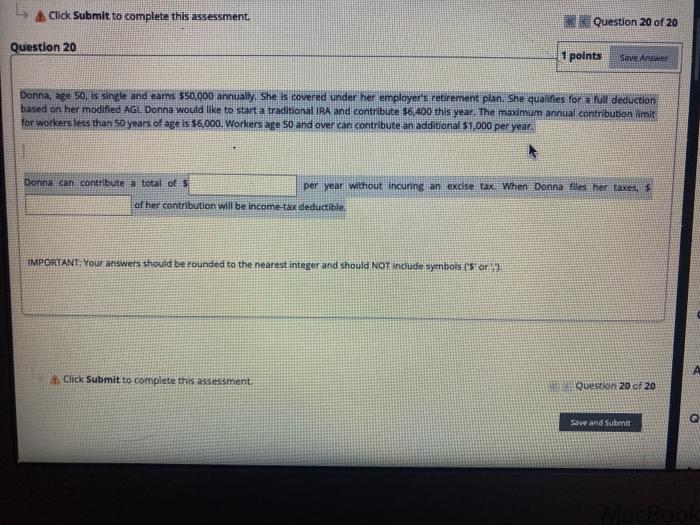

Question: 5 & Click Submit to complete this assessment Question 20 of 20 Question 20 1 points Save Answer Donna, age 50, is single and earns

5 & Click Submit to complete this assessment Question 20 of 20 Question 20 1 points Save Answer Donna, age 50, is single and earns $50,000 annually. She is covered under her employer's retirement plan. She qualifies for a full deduction based on her modified AGL Donna would like to start a traditional IRA and contribute 56,400 this year. The maximum annual contribution limit for workers less than 50 years of age is $6,000. Workers age 50 and over can contribute an additional $1,000 per year Donna can contribute a total of 5 per year without incuring an excise tax. When Donna files her taxes of her contribution will be income tax deductible IMPORTANT: Your answers should be rounded to the nearest Integer and should NOT include symbols Csor). Click Submit to complete this assessment Question 20 of 20 G Save and Submit 5 & Click Submit to complete this assessment Question 20 of 20 Question 20 1 points Save Answer Donna, age 50, is single and earns $50,000 annually. She is covered under her employer's retirement plan. She qualifies for a full deduction based on her modified AGL Donna would like to start a traditional IRA and contribute 56,400 this year. The maximum annual contribution limit for workers less than 50 years of age is $6,000. Workers age 50 and over can contribute an additional $1,000 per year Donna can contribute a total of 5 per year without incuring an excise tax. When Donna files her taxes of her contribution will be income tax deductible IMPORTANT: Your answers should be rounded to the nearest Integer and should NOT include symbols Csor). Click Submit to complete this assessment Question 20 of 20 G Save and Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts