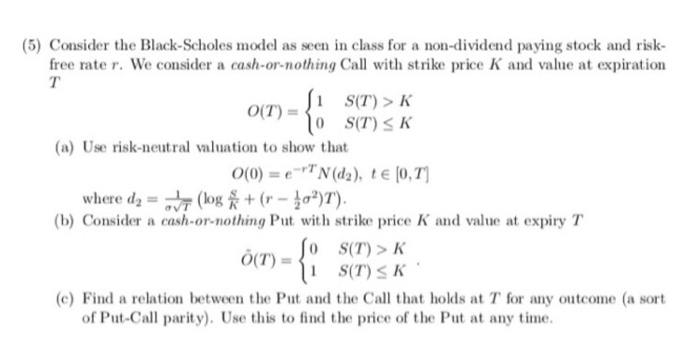

Question: (5) Consider the Black-Scholes model as seen in class for a non-dividend paying stock and risk- free rate r. We consider a cash-or-nothing Call with

(5) Consider the Black-Scholes model as seen in class for a non-dividend paying stock and risk- free rate r. We consider a cash-or-nothing Call with strike price K and value at expiration o(TS(T)> K 0(T) = 0 S(T) K (a) Use risk-neutral valuation to show that =e where d,-- b) Consider a cash-or-nothing Put with strike price K and value at expiry T S(T)>K S(T) 0 (T) = 1 K (c) Find a relation between the Put and the Call that holds at T for any outcome (a sort of Put-Call parity). Use this to find the price of the Put at any time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts