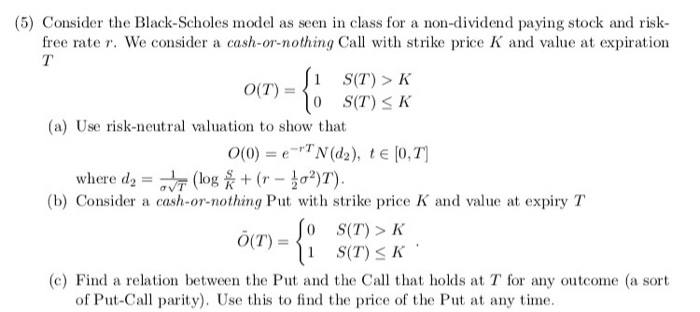

Question: (5) Consider the Black-Scholes model as seen in class for a non-dividend paying stock and risk free rate r. We consider a cash-or-nothing Call with

(5) Consider the Black-Scholes model as seen in class for a non-dividend paying stock and risk free rate r. We consider a cash-or-nothing Call with strike price K and value at expiration 0(T) = 0 S(T) K (a) Use risk-neutral valuation to show that 0(0)-= e-"N(4), te io, T] where d2 = (log + (r-22) T). (b) Consider a cash-or-nothing P with strike price K and value at expiry T 0 S(T)>K (c) Find a relation between the Put and the Call that holds at T for any outcome (a sort of Put-Call parity). Use this to find the price of the Put at any ime (5) Consider the Black-Scholes model as seen in class for a non-dividend paying stock and risk free rate r. We consider a cash-or-nothing Call with strike price K and value at expiration 0(T) = 0 S(T) K (a) Use risk-neutral valuation to show that 0(0)-= e-"N(4), te io, T] where d2 = (log + (r-22) T). (b) Consider a cash-or-nothing P with strike price K and value at expiry T 0 S(T)>K (c) Find a relation between the Put and the Call that holds at T for any outcome (a sort of Put-Call parity). Use this to find the price of the Put at any ime

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts