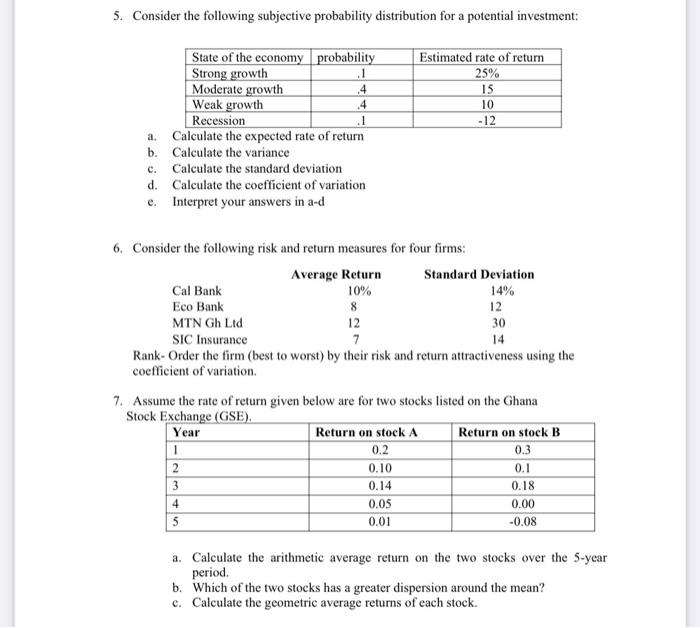

Question: 5. Consider the following subjective probability distribution for a potential investment: Estimated rate of retum 25% 15 10 -12 State of the economy probability Strong

5. Consider the following subjective probability distribution for a potential investment: Estimated rate of retum 25% 15 10 -12 State of the economy probability Strong growth .1 Moderate growth .4 Weak growth .4 Recession .1 a. Calculate the expected rate of return b. Calculate the variance c. Calculate the standard deviation d. Calculate the coefficient of variation e. Interpret your answers in a-d 10% 6. Consider the following risk and return measures for four firms: Average Return Standard Deviation Cal Bank 14% Eco Bank 8 12 MTN Gh Ltd 12 30 SIC Insurance 7 14 Rank-Order the firm (best to worst) by their risk and return attractiveness using the coefficient of variation 7. Assume the rate of return given below are for two stocks listed on the Ghana Stock Exchange (GSE). Year Return on stock A Return on stock B 1 0.2 2 0.10 3 0.14 0.18 4 0.05 0.00 5 0.01 -0.08 0.3 0.1 a. Calculate the arithmetic average return on the two stocks over the 5-year period. b. Which of the two stocks has a greater dispersion around the mean? c. Calculate the geometric average returns of each stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts